Picture this: your prices are sitting pretty at the status quo, while the world around you shifts faster than a squirrel on caffeine. Fear not! Price adjustment strategies are here to save your day, your wallet, and maybe even your Tuesday mood.

The goal? A strategy that juggles all the customer and market circus acts to maximize your revenue. Genius!

If you’d like a wider picture of how to structure your whole business idea and start the business, I’ve got a free eBook that will help you make up your thoughts and avoid mistakes.

From the clarity of the idea to the product solution, vision, and investment pitch: all here in the 8D Framework eBook.

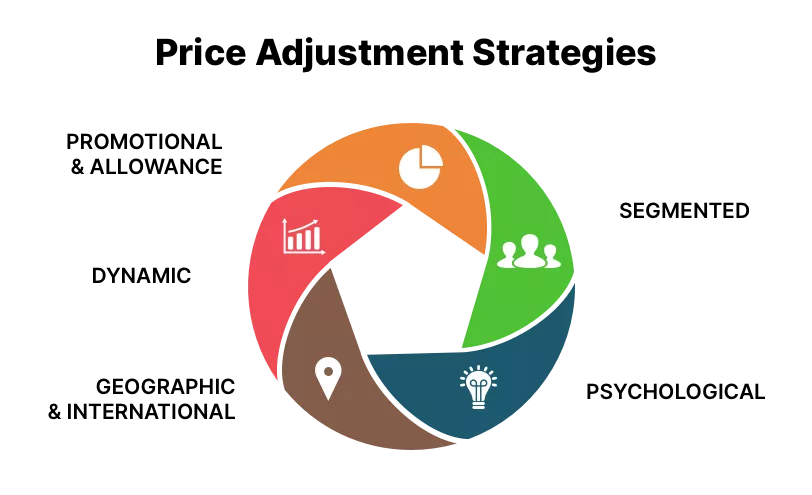

Need to nail the best offer for all those eclectic customer types? Here’s the scoop on five rockstar price adjustment strategies:

| Strategy | Description |

|---|---|

| Promotional and Allowance Pricing | Play the discount tango to reward early bird payments, bulky buys, or out-of-season shoppers. Urgency and loyalty? Double whammy! |

| Segmented Pricing | Different strokes for different folks. Adjust prices by group and product variations. Think location- and time-based pricing. |

| Psychological Pricing | Get into customers’ heads. Trick your customers into loving your price with anchoring and reference pricing. |

| Geographical and International Pricing | Tailor prices for life on the road. Account for freight, local economies, and quirky laws and regulations. |

| Dynamic Pricing | Adjust prices based on the specific situation or customer. Think gas stations adjusting prices based on crude oil prices or Ticketmaster inflating prices for in-demand concerts. |

How to create urgency and build loyalty?

Should you be offering discounts all the time? No way! You risk drowning your brand image in sale stickers. But you can see payment discounts, quantity discounts, and seasonal discounts as a way to “buy” customers. For example, offering the “2/10, net 30” payment terms is an investment in faster payments, just like advertising is an investment in attracting more customers.

You also shouldn’t be over-reliant on discounts to make money. Offering bonus products or enhanced value propositions to attract customers genuinely interested in the product’s long-term value encourages you to think beyond short-term gains and focus on building sustainable pricing models that attract loyal customers.

But how big a discount should you be offering? That all depends on these factors:

For customer-segment pricing, different groups are charged differently. Think about museums that offer cheaper tickets to students and older people.

For product-form pricing, different versions of the product are priced differently. Think about Evian water spray, sold at spas and beauty stores for $8, while the same water in a plastic bottle costs $1 in a supermarket.

For location-based pricing, location affects price. Think theaters that charge more for being near the stage.

For time-based pricing, prices vary depending on the time of year and how in advance you’re buying. Think plane tickets for tomorrow rather than next year.

For the magic to work, your market must look like a delicious layer cake, not just plain pudding:

You need to be a master of segmentation to get this strategy spot on, so make sure to check out our complete guide on market segmentation.

Price itself often determines the customer’s perception of the product’s quality, which we talk more about in our What Is a Price? article, so use these tactics:

While psychological pricing is probably going to be the most fruitful strategy, customers are increasingly seeing through these techniques. That’s why it’s important to offer more sophisticated and less obvious methods.

This is where language skills play a big role. Saying “Don’t lose out on a 10% saving” is tapping into the loss aversion that is more psychologically significant than the thrill of gaining something. This subtle shift in language taps into the reader’s inherent desire to avoid missing out on a good deal, making the pricing strategy more effective.

The rise of subscription box services like Birchbox and Dollar Shave Club has introduced a new dimension to psychological pricing. By offering a curated selection of products at a seemingly discounted price, these companies leverage the “fear of missing out” and the perceived value of exclusivity to attract customers.

There are a few things you need to consider before adopting this strategy. For example, do you want to risk losing business from distant customers by charging additional shipping costs?

Geographical pricing comes in different shades, so you need to think about which one is right for your business:

To navigate different locales, you need more than a compass:

Listening to the controversy surrounding the Oasis tickets, you might think dynamic pricing is a new phenomenon. You’d be dead wrong. Think about how markets operated in the ye olden days. Prices would fluctuate depending on how good the harvest was, or if not many customers showed up on market day (because they had the plague).

The key thing is to not look like you’re just ripping customers off. See one price on the website and then get a bigger number at checkout? You’d be right to be pissed. Amazon was accused of price gouging when their Black Friday deals seemed to change every minute. Appearing unethical is definitely going to harm your brand’s reputation.

In an ideal world, you would get customers to outbid each other for your product. But the feeling of needing to have the product even when the price soars need to reflect the extra value customers see in the product. This is where marketing must communicate things like exclusivity, time sensitivity, and limited availability.

While these strategies are going to help you a lot, the rise of social commerce is changing the way businesses approach pricing. With platforms like TikTok and Instagram becoming major sales channels, incorporating social proof, influencer marketing, and limited-time offers into pricing strategies is crucial.

The way you price your products influences how your brand is perceived, its reputation, the judgment of quality and value, and how ethical your company appears. There is a growing tendency for companies to use more ethical pricing strategies so they don’t look like that evil pharma bro who charged nonsensical amounts for life-saving drugs.

Customer perception of value should be the focus of your pricing strategy. Value-based pricing is particularly effective in service and digital product industries where the cost of production is low but the value to the customer is high. For instance, a business management course might be priced at $300-$500 despite low production costs because it offers significant value to budding entrepreneurs.

Are you a startup founder whispering sweet MVP? Whisper louder: “How can I mine more value from it?” A strategic, clear revenue model is your guiding light.

Email subscription is available ONLY TODAY (oh, okay, and tomorrow).

Surely, we respect your inbox! Unsubscription works every day.

We’d love to tailor your experience — which of these best describes you?