Pricing might just be the most important, but also trickiest part of your business.

Most founders start by looking at their product, blurting out a random number, squinting their eyes, and saying…

“Mmmmm… sounds about right!”

And then, they defend it like it’s sacred. But pricing is NOT a gut feeling.

It’s a business decision.

One that can be optimized, tested, improved.

The right price won’t just bring in more revenue. It communicates your value, your market position, and your confidence.

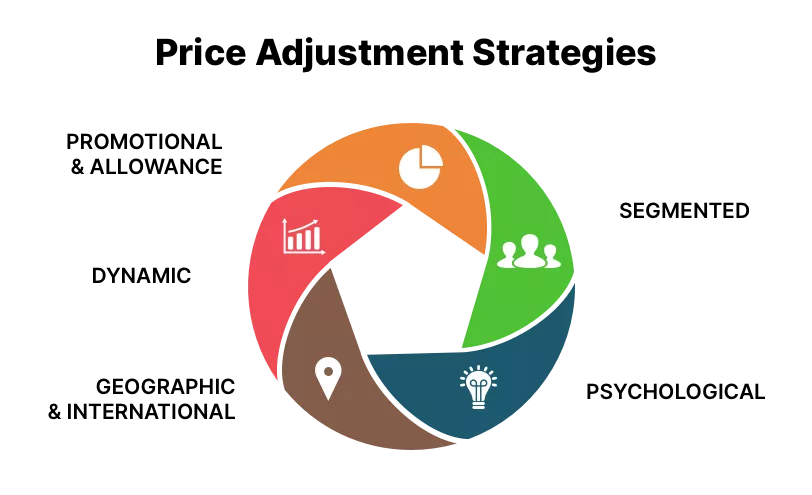

In this article, I’ll show you the 5 price adjustment strategies every founder MUST know about to dramatically increase their revenue… and make 5x the business progress you would otherwise.

Before we even get into the strategies, you need to know what you’re optimizing for.

Your pricing shouldn’t be one-size-fits-all – it should match your stage of business.

If you’re in the idea/MVP stage…

Your pricing is more about testing perception than hitting targets.

You want to learn what your ideal customer is willing to pay and how they frame value.

If you’re in the early revenue stage…

You’re probably balancing growth and validation.

This is where segmenting and psychology can give you an edge while you still keep your customer acquisition cost (CAC) low.

If you’re scaling…

Welcome to margin optimization mode.

You’re no longer just trying to convert – you’re trying to win on efficiency, sustainability, and perception.

| Strategy | Description |

|---|---|

| Promotional and Allowance Pricing | Play the discount tango to reward early bird payments, bulky buys, or out-of-season shoppers. Urgency and loyalty? Double whammy! |

| Segmented Pricing | Different strokes for different folks. Adjust prices by group and product variations. Think location- and time-based pricing. |

| Psychological Pricing | Get into customers’ heads. Trick your customers into loving your price with anchoring and reference pricing. |

| Geographical and International Pricing | Tailor prices for life on the road. Account for freight, local economies, and quirky laws and regulations. |

| Dynamic Pricing | Adjust prices based on the specific situation or customer. Think gas stations adjusting prices based on crude oil prices or Ticketmaster inflating prices for in-demand concerts. |

If not, I’d love for you to have my free Startup Launch Roadmap.

It’s a step-by-step guide designed to show you how to raise investments, build a product or service, launch it, and keep scaling as long as you want to.

If you’re an entrepreneur in ANY industry… you’ll find it really useful (plus it’s free!):

Aka: the adrenaline shot.

Done well, this can trigger urgency, build loyalty, help you recoup cash flow, and make a TON of sales.

Seriously, launches can literally make up most of your yearly revenue.

But do it poorly… and you’ll just look like a desperate discount machine.

You can use discounts to reward behavior. Early payment, bulk buying, referrals, seasonal timing – all solid plays.

But there’s a reason we don’t have Black Friday every week!

If you lean on discounts too hard, you dilute your value, not just your margins.

Discounts PUNISH your recent customers, instead of rewarding them.

People who just purchased a product at full price should be the people you REWARD. Not the ones you alienate.

This is really a pro tip.

If you decide to put something on discount, make sure to give your recent customers an even BETTER deal!

Here are some more discount strategy tips:

Note: Don’t forget about your metrics!

Compare the cost of discounting to your CAC. If it’s cheaper than ads, go for it. If it’s not… step away from the coupon generator.

This one’s all about leverage.

Different customers perceive value differently – and segmented pricing lets you capture that value instead of leaving it on the table.

For example:

But founders make one huge mistake here: they assume more segments = more revenue.

Nope.

You only win here if the segments are actually real.

There has to be a clear difference in either value perception or usage behavior.

Think: freelancers vs agencies. “Basic onboarding” vs “done-for-you onboarding.” Off-peak access vs prime-time.

And if you’re still not sure which way to segment, start with time.

It’s the easiest one to test (launch pricing, early access deals, etc.), and customers already understand it.

This one is especially powerful for early-stage founders because it lets you increase perceived value without actually changing the offer.

Repeat after me:

People are irrational, but predictably so.

We anchor. We compare. We avoid loss more than we seek gain.

So when you slap a premium offer at the top of your pricing page, you’re not trying to sell it — you’re trying to make your mid-tier look like a deal.

When you reframe “Get 10% off” as “Don’t miss your 10% savings,” you’re triggering loss aversion.

But let’s be honest — these techniques are the sprinkles, not the cake. If your product sucks or your messaging is fuzzy, you won’t trick anyone into buying.

Psychology works best when it reinforces real value.

So you’re selling globally? Good.

Just don’t assume your price should stay the same everywhere.

There’s a big difference between “affordable in New York” and “affordable in Mexico City.”

Same product, WILDLY different buying power.

That’s where regional pricing comes in.

You could use:

And no, this doesn’t mean you’re being unfair. It means you’re being thoughtful. Global scale doesn’t mean global uniformity.

Test your pricing in your top 3 countries. You might be surprised where your biggest margin is hiding.

This one gets a bad rep (but hey, we’re just trying to make a living here. A nice living.)

And yeah, if you’re inflating your prices by the hour like a scalper bot, you’re going to piss people off.

But when used strategically, dynamic pricing can feel… kind of elegant.

Once again, your safest bet is time-based pricing.

Early bird spots start at $99, regulars can be $149, and latecomers $199.

This rewards action-takers, creates urgency, and boosts perceived value without feeling manipulative. This logic is clear to EVERYONE (and few will hate you for it)

You can also raise prices as capacity shrinks (“Only 5 coaching spots left at this rate”), or when features unlock.

Just don’t lie and say “5 MORE IN STOCK!”… for a f*cking digital product.

Explain why prices change. Make it part of the story. People get it, as long as there’s a ‘narrative’ behind it.

This is difficult for everyone. No one believes in themselves enough at the beginning.

But let me help you overcome your internal battles for a second.

Premium prices bring premium results.

Not just for you, but for your customers.

People show up differently when they’ve invested real money.

They pay attention. They take action. They don’t ghost you the moment life gets inconvenient.

They even give you better resources to work with. They HAVE to. They put REAL money on the line!

And then, there’s the ‘value perception’…

A $10 book and a $100 book might say the same thing. But the $100 one feels more important.

You treat it with more respect. You expect more from it. And so you get more from it.

Founders often hesitate here because they’re worried people won’t buy. But it’s not about what “everyone” will pay — it’s about what the right people will pay.

You’ll find that a $300 client often treats it like the biggest decision of their life.

They hesitate. They overthink. They send five emails before the kickoff call.

Meanwhile… the $8000/month client wires the money and just says, “Done. When do we start?”

Higher-paying clients are usually easier to work with. They get better results. They refer better people. And the whole relationship feels lighter — more professional, more collaborative, more fun.

It doesn’t matter if you’re in SaaS, coaching, agency work, or even productized services. When your product creates meaningful outcomes, your price should reflect it.

Not as an ego trip, but as a filter.

Pricing is one of the most powerful tools in your business. It influences how your product is perceived, how profitable you are, and who you attract as a customer.

The five strategies you just learned give you a clear way to adjust your price with confidence, and finally start charging like a founder who knows what they’re doing.

Let’s recap what you should take from this:

Email subscription is available ONLY TODAY (oh, okay, and tomorrow).

Surely, we respect your inbox! Unsubscription works every day.

We’d love to tailor your experience — which of these best describes you?