Cost-based Pricing is another approach to pricing. We have already learned about customer-value-based pricing. Customer-value perceptions set the price ceiling: customers would not be willing to pay more. But costs represent the other extreme: costs set the floor for the price that the company can charge. Therefore, we should closely investigate the cost-based pricing method.

Cost-based pricing involves setting prices based on the costs of producing, distributing, and selling the product. Also, the company normally adds a fair rate of return to compensate for its efforts and risks. To begin with, let’s look at some famous examples of companies using cost-based pricing. Firms such as Ryanair and Walmart work to become low-cost producers in their industries. By constantly reducing costs wherever possible, these companies can set lower prices. Certainly, that leads to smaller margins, but greater sales and profits on the other hand. But even companies with higher prices may rely on cost-based pricing. However, these companies usually intentionally generate higher costs so that they can claim higher prices and margins.

Before going on, we should investigate the different types of costs. A company’s costs can take two forms: fixed and variable. Fixed costs, which are also known as overhead costs, do not vary with production or sales level. Examples are the monthly rent, interest, or salaries. Variable costs, on the contrary, vary directly with the level of production. Each car produced by Chevrolet involves a cost for the inputs used, such as the steering wheel, wires, etc. Although these costs are the same for each unit produced, they vary with the number of units produced. Finally, total costs are the sum of the fixed and variable costs for any given level of production.

Returning to our thoughts on cost-based pricing, we see that total costs are most important: the company wants to charge a price that will at least cover the total production costs at a given level of production.

Especially in fierce markets (competitive markets), companies must watch their costs carefully. If it costs the firm more than its competitors to produce and sell a similar product, the company will eventually need to charge a higher price or make less profit.

Cost-plus pricing is the simplest pricing method. It is also called markup pricing and means nothing else than adding a standard markup to the cost of the product. Of course, the standard markup should account for the profit. Lawyers, accountants, and other professionals typically price by adding a simple standard markup to their costs, using this simple cost-based pricing method.

Let’s look at an example: a toaster manufacturer has the following costs: Variable costs: $10, Fixed costs: $300,000. Expected unit sales are 50,000.

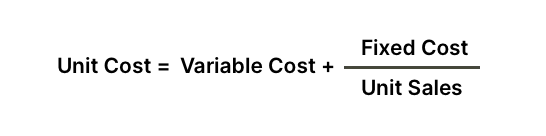

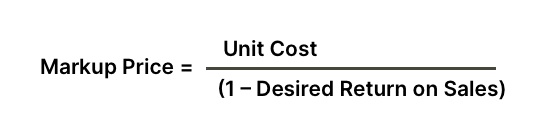

To calculate the unit cost, we need the following formula:

In our example that is:

Toaster Unit Cost = $10 + $300,000 / 50,000 = $16

Now suppose the company wants to earn a 20 percent markup on sales. The markup price in cost-based pricing is determined by the following formula:

Toaster Markup Price = $16 / (1 – 0.2) = $20

Consequently, the company will charge dealers $20 per toaster and hence make a profit of $4 per unit. The dealers, in turn, will add their own markup, making the product more expensive for the final customers.

BUT: Does Cost-plus pricing make sense? Generally, no. This cost-based pricing method may appear promising due to its simplicity, but it ignores demand and competitor prices. Therefore, it is not likely to lead to the best price.

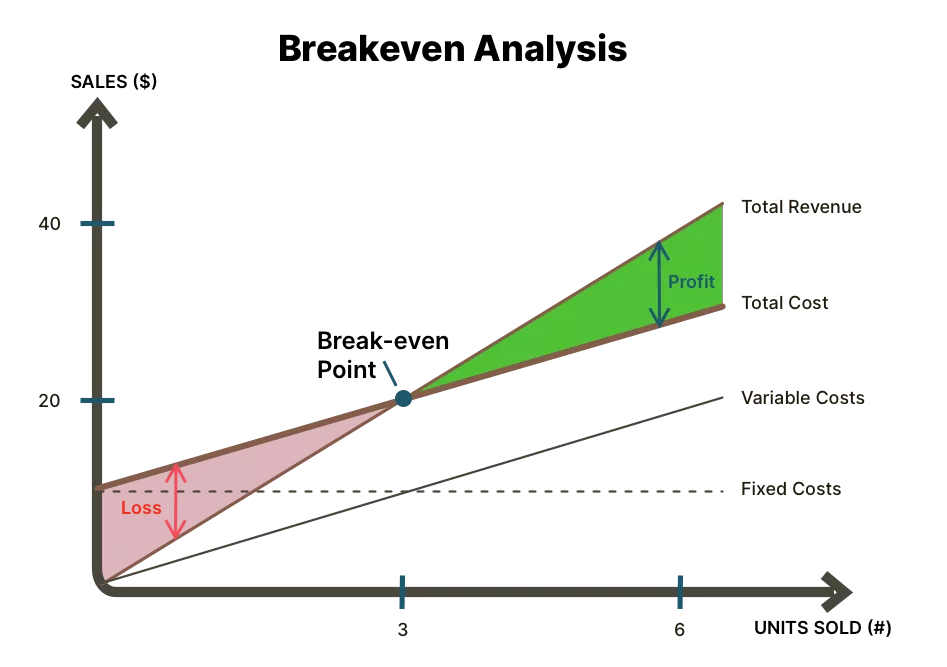

Another approach to cost-based pricing is break-even pricing, or its variation target-return pricing. The company determines the price at which it will break even or make the target return.

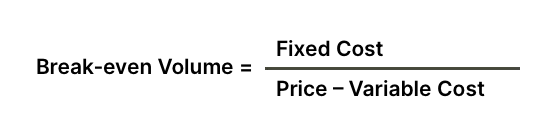

Where total costs and total revenue lines in a break-even chart cross, the break-even volume is reached. It can be calculated using the following formula:

Toaster Brean-even Volume = $300,000 / ($20 – $10) = 30,000

That means, the company must sell 30,000 units at $20 each to breakeven. If it wants to make a profit, it needs to sell more than 30,000 units.

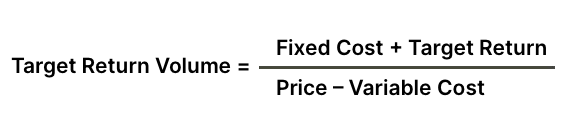

With a target return included, the formula changes slightly:

For instance, if the company has invested $1,000,000 in the business and wants to set a price to earn a 20% return (=$200,000), it must sell at least 50,000 units at $20 each.

Remember that customer-value-based pricing is generally considered to be a better approach than cost-based pricing. The reason is that cost-based pricing ignores what customers are willing to pay – what the product is worth in their eyes.

Also, cost-based pricing does not consider competitors’ prices. Eventually, the company must be certain to give customers superior value for the price charged.

Email subscription is available ONLY TODAY (oh, okay, and tomorrow).

Surely, we respect your inbox! Unsubscription works every day.

We’d love to tailor your experience — which of these best describes you?