Ever feel like you’re juggling too many balls in your business? Sourcing materials, managing production, dealing with distributors…

Maybe it’s time to bring some of that chaos in-house. We’re talking about vertical integration, folks!

It’s like building your own entrepreneurial empire, brick by metaphorical brick.

But hold your horses! Before you go full-on Willy Wonka, let’s break down what vertical integration REALLY means, its benefits and pitfalls, with real-life examples of small businesses that got it right—or wrong! and why some small businesses fail at it, and how you can avoid their mistakes.

Vertical integration is like taking your business by the reins—literally. It’s about owning or controlling different stages of your supply chain, from the raw materials to the final product. Instead of relying on a bunch of middlemen who may or may not deliver (literally), you’re the one calling the shots. It sounds empowering, right? But, as with all things in life, there’s a catch—or a few.

If a company takes over all the activities (or operations) in its supply to gain total control from supply of raw materials to production, distribution, and direct sales to customers; it is referred to as Balanced or complete integration. If it controls some operations, it is regarded as a Partial integration.

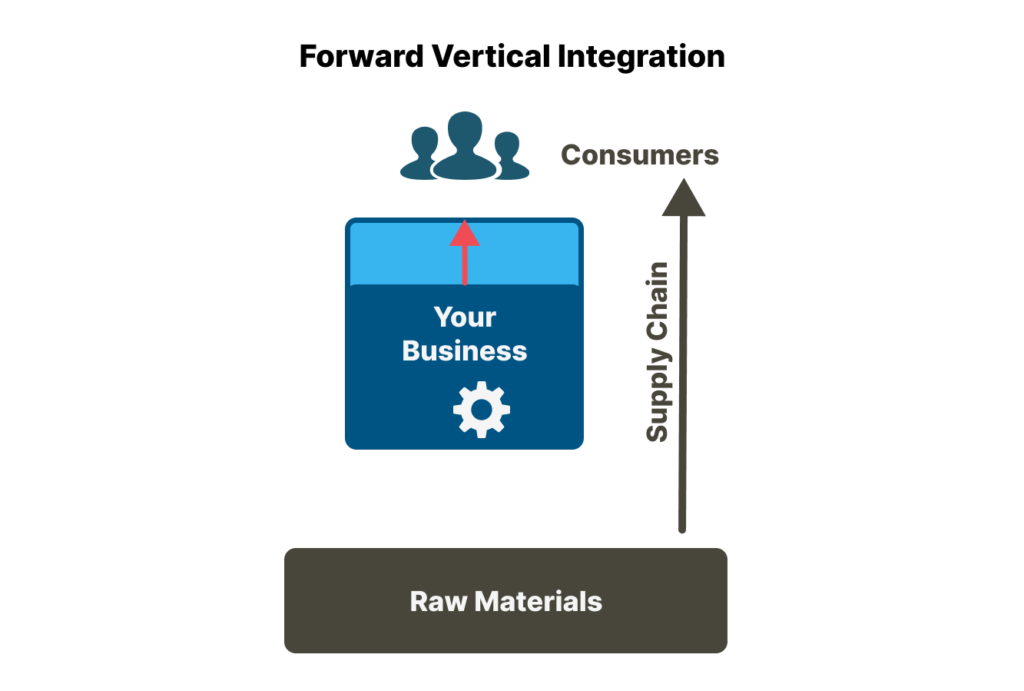

Forward vertical integration is a business strategy that involves a company advancing downstream in the supply chain. The downstream of the supply chain extends from the point at which goods are produced to the point that they are sold to consumers.

It is like moving closer to your customers—literally. It’s when a company decides to take charge of everything that happens after their product rolls off the production line.

Picture it as a relay race where, instead of passing the baton to someone else, you decide to run every leg of the race yourself, from production to the final handoff to the customer. By owning the steps that come after production, companies can ensure their products get to consumers just the way they want—quickly and efficiently.

This means that a company, when implementing forward vertical integration owns and controls the business activities that come after production such as the direct distribution or supply of its products.

Amazon:

Amazon applied a forward vertical integration strategy through Amazon Transportation Services (ATS). This controls the transport and distribution of eCommerce items to the end user. That is, the company makes a move forward in the supply chain by owning and directly controlling delivery to end users rather than relying on third-party delivery and logistics services.

This has been beneficial to the company as the ATS saves money and is the fastest and most convenient way of delivering packages to customers around the world.

Nike:

This company in 2011 vertically integrated forwards through its Consumer Direct Acceleration; what it really means is that they wanted to sell directly to you—the consumer—without any middlemen getting in the way. It’s like if Nike said, “Why should we let stores sell our shoes when we can do it ourselves?” By focusing on direct-to-consumer (DTC) sales, Nike not only boosted its profits but also gained more control over how its brand was presented to the world.

This move was so significant that Nike even pulled its products from Amazon, saying, “Thanks, but no thanks!”. By selling more products directly to the consumer, the company focused on having more control of its supply chain by elevating consumer experiences through more direct and personal relationships.

This strategy paid off big time! DTC sales skyrocketed from 16% of Nike’s revenue in 2011 to a whopping 35% by 2020. That’s like going from a casual jog to a full-on sprint! By selling directly to you, Nike has been able to elevate your shopping experience while keeping their brand image intact.

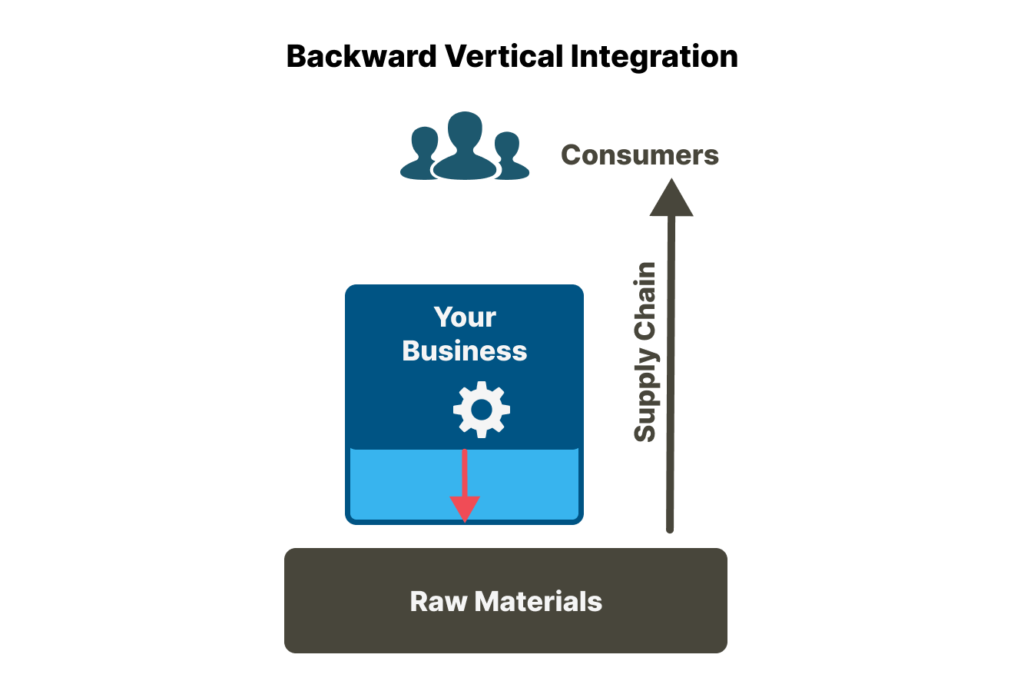

This is a type of integration wherein businesses merge with or acquire the supplier of inventory or raw materials in their supply chain. That is a business that integrates backward, owns, and produces the earlier-stage inputs in the supply chain instead of buying them from external companies.

A lot of companies employ vertical integration strategies as a means to take over a portion of their supply chain.

Hence, implementing a backward vertical integration strategy involves a company expanding its role to perform the tasks that were formerly carried out by businesses up the supply chain. That is, the company acquires or merges with another company that supplies the raw material, inventory, or services that it needs for its production.

Alternatively, the company can also establish its own subsidiary to perform the tasks of the suppliers. Hence, backward vertical integration involves gaining ownership of part of the supply chain that occurs before the manufacturing process of a company.

Companies may consider integrating backward for technological expertise or efficiency enhancement.

🚨 LET’S TAKE A BREAK FROM INTEGRATION FOR A SECOND, SHALL WE? 🚨

Thank you.

I want to quickly integrate my 8D Framework To Launch Your Business eBook in your life.

It’s a step-by-step guide designed to help you make your product, launch it perfectly, and continue scaling it as much as you want.

If you’re starting a new business, you’ll find tremendous value inside, trust me. You could do much worse things with your time then to check it out here:

Nestle:

Nestlé as a food and beverage company has implemented vertical integration in many of its business operations; this has increased the profitability and efficiency of the company.

One of Nestlé’s biggest strengths is its backward vertical integration strategy; Nestlé isn’t just making food; they’re growing the stuff too. They own the farms, the factories, and the distribution centers, so they’ve got the whole operation locked down. This way, they keep the quality on point and avoid any hiccups in their supply chain. Talk about having your cake and eating it too!

Tesla:

It uses both backward and forward vertical integration. The company integrates backward by making most of the components used in the manufacture of its cars. It produces its own batteries and also makes in-house auto-driving software without relying on third-party companies.

This gives Tesla a competitive advantage over other automakers.

Netflix:

Netflix integrated backward by creating its own original content; Currently, it streams more original content and reduces its dependence on film studios and their licensing.

It started as a DVD rental company that distributed the films and TV shows created by others but later integrated backward by creating its own original content.

This increases its profit margins and allows it to tailor content based on the needs of the audience (helping Netflix gain control over its supply chain).

| Company Name | Product | Type of Vertical Integration |

|---|---|---|

| Tesla | Electric vehicles | Forward Vertical Integration |

| Apple | Consumer electronics | Backward Vertical Integration |

| Amazon | E-commerce platform | Forward and Backward |

| ExxonMobil | Petroleum products | Backward and Forward |

| Ford Motor Company | Automobiles | Forward Vertical Integration |

| Nestlé | Food and beverages | Backward Vertical Integration |

| Netflix | Online streaming service | Backward Vertical Integration |

| Boeing | Aircraft manufacturing | Forward Vertical Integration |

| Samsung | Consumer electronics | Backward and Forward |

There are various reasons why a company may decide to apply this business strategy.

Studies indicate that small businesses can achieve substantial cost control through vertical integration and another research shows that companies that vertically integrate often experience long-term cost savings.

Sweetgreen, a fast-casual restaurant chain focused on healthy salads, has implemented vertical integration by partnering directly with local farmers. This strategy has helped the company reduce food costs and ensured the freshness of its ingredients.

Brewery Ommegang, a craft brewery based in New York, has adopted vertical integration by controlling its supply chain from grain sourcing to brewing and packaging. This strategy has allowed them to reduce costs associated with raw materials and distribution.

Birds Eye (Agriculture and Food Processing): although now a well-known brand, started as a smaller operation in the frozen foods industry. It is vertically integrated by controlling the entire production process—operating farms, processing plants, and distribution channels. This allowed Birds Eye to cut costs by bypassing intermediaries and controlling quality at every stage.

The benefits are most evident when the business can control both production and distribution efficiently, as shown in the Birds Eye example.

Vertical integration enables small businesses to manage multiple stages of production, from raw materials to finished goods, this ensures strict adherence to quality standards and minimizes the risk of defects or contamination.

Blue Apron:

Blue Apron, a meal kit delivery service, has vertically integrated by sourcing ingredients directly from suppliers and managing its own production facilities. This control over the supply chain allows Blue Apron to ensure the quality and freshness of its ingredients, leading to a better customer experience and improved product quality.

Ben & Jerry’s:

Ben & Jerry’s is another notable example of a small business that has achieved quality control through vertical integration. The company owns its own farms and manufacturing facilities, allowing it to have complete control over the quality of its ingredients and the production process.

This includes sourcing milk and cream from family farms that do not use synthetic hormones, as well as eggs from certified humane cage-free farms. This control helps maintain the quality of the raw materials used in their ice cream production.

This ensures that the ice cream it produces meets the high standards consumers expect.

Vertical integration enables faster innovation and responsiveness to market changes, ensuring that businesses maintain a competitive edge while meeting evolving customer demands.

Farmhouse Culture is a small business specializing in fermented foods; Farmhouse Culture benefited from vertical integration by controlling its production processes. This allowed them to quickly respond to growing consumer interest in gut health and probiotic-rich foods. This has helped them to introduce new products, like probiotic-rich chips, in response to market trends favoring healthy snacking options.

By being more responsive to market changes, vertically integrated small businesses can maintain a competitive edge, ensuring they not only meet but anticipate customer demands, ultimately leading to increased customer satisfaction and loyalty.

By controlling resources and materials, vertically integrated companies gain market power and can influence pricing and product availability.

Take Beecher’s Handmade Cheese, for example. These guys started out small in Seattle, but they’ve got a lock on the entire cheese-making process. They own the dairy farms that supply the milk, they control the cheese production, and they sell directly to consumers through their own stores and websites. It’s like a cheese monopoly, but in the best way possible!

By having their hands in every step of the game, Beecher’s can ensure their cheese is always top-notch. They can also call the shots on pricing and make sure their signature cheeses are always in stock, even when the dairy market is going nuts. It’s like having a cheat code for the cheese world.

Implementing vertical integration requires significant upfront capital expenditure for acquisitions, infrastructure development, and new technology.

Yummus Foods (Agricultural Sector): A Guatemalan SME, contracted its processing services rather than vertically integrating its garbanzo-based snack production. However, this decision was strategic due to the capital-intensive nature of vertical integration, especially for smaller businesses in developing economies.

This example highlights that vertical integration is not always the best choice for small businesses, even though it can lead to long-term benefits like cost control and operational efficiency when successfully implemented.

Integrating new operations into existing processes can cause significant organizational complexity, making management and resource allocation more challenging for small businesses pursuing vertical integration strategies.

Acquiring or merging with related businesses requires aligning different corporate cultures, management styles, and operational procedures. This integration process can strain resources and divert attention away from core competencies, potentially leading to inefficiencies and suboptimal performance in the short term.

Innocent Drinks:

A notable example is Innocent Drinks, a small smoothie company in the UK. As Innocent Drinks grew, they decided to vertically integrate by taking over their own production facilities instead of outsourcing. This decision led to significant operational challenges.

The company faced difficulties in managing the newly acquired production processes, which were more complex than their previous business model of simply marketing and distributing their products.

It also needed to ensure that all suppliers met its stringent sustainability and quality standards, which necessitated extensive vetting and ongoing monitoring.

The increased operational complexity required more sophisticated management structures and stretched the company’s resources thin, ultimately leading to inefficiencies and increased costs.

Oak Furnitureland:

Another example is Oak Furnitureland, a UK-based furniture retailer that integrated vertically by acquiring its supply chain. Oak Furnitureland decided to control its manufacturing and supply operations to ensure the availability and quality of its products. However, the integration led to increased organizational complexity, particularly in managing the logistics and manufacturing processes.

The company had to deal with the intricacies of sourcing raw materials, managing production timelines, and coordinating logistics, which were previously handled by their suppliers. This complexity strained their management capabilities, leading to operational inefficiencies and challenges in maintaining consistent product quality. The company was sold in 2020 after it had been affected by a challenging retail environment coupled with the adverse trading conditions imposed by the Covid-19 pandemic.

This shows that vertically integrated companies often have to navigate complex regulatory environments, as they may be subject to antitrust scrutiny or industry-specific regulations at multiple stages of the supply chain.

Managing these legal and compliance requirements across different business units can add to the overall complexity, requiring specialized expertise and additional resources.

Small businesses must carefully assess their ability to absorb these complexities and ensure that the benefits of vertical integration outweigh the potential drawbacks of increased organizational challenges.

When companies expand through vertical integration, they often acquire or develop businesses that operate in different stages of the value chain.

This can divert resources and attention away from the company’s core business, potentially hindering growth and success. For instance, a manufacturing company that integrates into the raw materials supply chain may find itself stretched thin, and unable to devote sufficient resources to research and development or product innovation.

A study examining the relationship between vertical integration and financial performance in German manufacturing firms provides valuable insights into this issue.

The study found that while a moderate degree of vertical integration can enhance performance, excessive integration can be detrimental. This suggests that while expanding into adjacent businesses may offer certain advantages, it is essential to maintain a focus on core competencies to ensure long-term success.

Expanding through vertical integration necessitates consistent growth, which can be achieved through various means. However, high investment intensity in vertical integration often requires significant capital expenditures. If the resulting operating cost savings are not substantial enough to offset these investments, the overall profitability of the enterprise can be compromised.

Therefore, businesses, especially small enterprises should carefully consider factors such as financial stability, strategic planning, risk management, and return on investment before embarking on a vertical integration strategy.

A 2024 study showed that many small agribusinesses in Guatemala City, despite their low revenues, are compelled to integrate due to a lack of reliable service providers. However, they face challenges like high capital requirements and regulatory burdens. To assist investors in navigating these complexities, a decision-making framework based on empirical analysis could help in making more informed investment decisions in smallholder agriculture.

Different industries exhibit varying trends in vertical integration. For instance, technology companies may focus on R&D and direct-to-consumer sales, while the pharmaceutical sector may prioritize securing raw materials. Tailoring integration strategies to industry needs is crucial for success.

Instead of fully committing to vertical integration at once, small businesses can start with smaller, manageable projects. This allows them to test the waters and gradually expand their integrated operations as they gain experience and confidence.

This involves contracting third-party companies to handle specific business functions or services. This strategy allows businesses to focus on their core competencies while reducing costs and increasing efficiency. For example, a manufacturing company might outsource its marketing or logistics functions, enabling it to concentrate on production without the complexities of managing those areas internally.

Forming strategic alliances with other businesses can help companies share resources, knowledge, and capabilities. These partnerships can enhance market reach, improve product offerings, and reduce risks associated with entering new markets.

Undercover Boots, a small company based in Panama that produces unique rubber rain boots, partnered with DHL Express for shipping services. This partnership allowed Undercover Boots to expand its international reach significantly, increasing sales by 126% since the collaboration began.

By leveraging DHL’s logistics expertise, Undercover Boots could focus on product development and marketing without the complexities of managing its own shipping operations.

Wix, a web development platform, teamed up with Vistaprint, a printing service, to offer joint customers the ability to design websites alongside their marketing materials. This partnership enhanced the product offerings of both companies and provided a more comprehensive service to their clients, sharing marketing costs and resources.

This shows exploring other business strategies may be a better choice for your small business than implementing vertical integration.

Email subscription is available ONLY TODAY (oh, okay, and tomorrow).

Surely, we respect your inbox! Unsubscription works every day.

We’d love to tailor your experience — which of these best describes you?