Alright, let’s talk pricing. It’s not just about slapping a number on your product and calling it a day. Nope, it’s the secret sauce to your business success. That’s right, your marketing, brand awareness, and profits are all affected by the price.

Want to charge a premium for your product? Or maybe you’re looking to sneak under your competitors’ radar with budget prices? Whatever floats your boat. Figuring out how to choose the right pricing strategy for your business can make or break your sales game.

We have a great guide on how price communicates value and quality and influences purchasing decisions, providing a crucial framework for understanding the psychological and economic aspects of pricing. But here’s our deep dive into the kinds of pricing strategies you can adopt to get your startup off the ground.

A pricing strategy… sounds kinda fancy, right? It’s just a smart way to figure out the perfect price for your product or service. Nail it, and you’ll see your marketing efforts pay off, like, big time.

Effective pricing strategies aren’t just throwing darts at a board. They consider the magical Four Ps: Product, Place, Price, and Promotion. And let’s not forget market demand, consumer behavior, product characteristics, your business goals, and all those juicy economic patterns. Oh, and of course the competition.

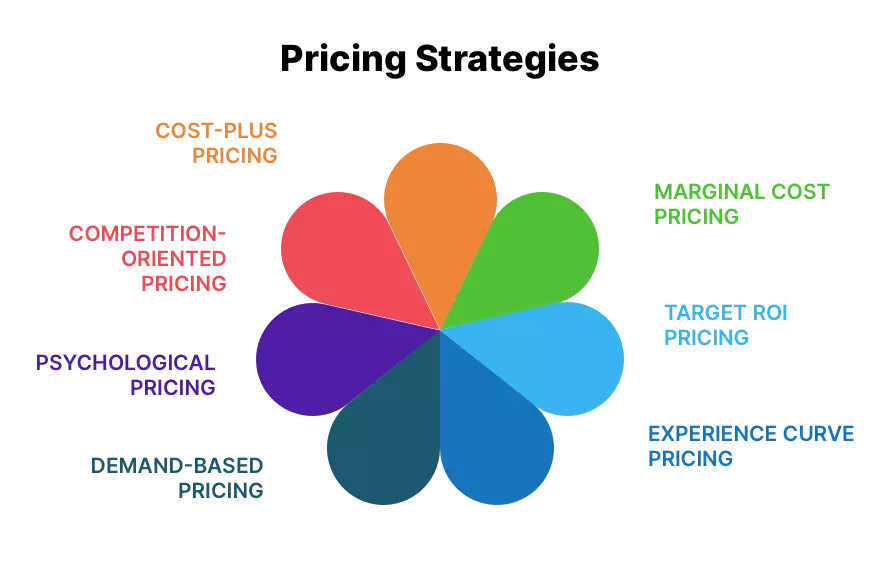

Here are 7 common effective pricing strategies for small businesses to get those profits firing:

Cost-oriented pricing is the most elementary pricing method. Add up your costs (both fixed and variable) and sprinkle a little markup on top. Voilà, here’s your price. Simple, yes. But it might miss the whole demand and competition thing.

Cost-plus pricing is popular among many retailers and wholesalers. Think Walmart. Low prices, still profitable.

Pretty similar to cost-plus pricing but only covers part of the costs, focusing solely on production. This means that the cost is less than might otherwise be expected and a more competitive price can be charged. More competitive prices, but it’s a risky business in the long run.

Look at energy companies. They price based on the cost per unit.

This one’s a numbers game, similar to cost-plus pricing. Calculate how much you need to charge to hit a specific ROI, assuming you know the costs. Simple, but it also faces those pesky cost-based challenges.

The calculation is straightforward:

An example is a sports team pricing tickets to pay off that new stadium debt.

As you make more products, costs drop. So, you lower prices over time, leveraging that “been there, done that” vibe. But beware of labor efficiency and work specialization in your calculations.

For example, the price of solar panels has come down as more and more of them have been produced.

Adjust your prices based on how much folks are willing to pay. Peak times? Higher prices. Slow times? Lower prices. Easy peasy.

This method requires accurate volume forecasts and cost calculations at different demand levels. You can only improve what people use. What they don’t use needs to be changed. So, use data to analyze the behavior of real customers and how they respond to different price points.

Tech companies use this to adjust subscription prices when demand dips.

Check out our guide on market segmentation, which is needed to properly understand customer demand.

Using mind tricks to make people feel better about spending money. When consumers can judge the quality of a product by examining it, or by calling on past experience, they use price less to judge quality. When consumers cannot judge quality because they lack the information or skill, price becomes an important quality signal.

Here are some examples:

Engage with existing clients to understand their perceived value and the reasons behind their purchasing decisions, helping you tailor pricing strategies to evoke the desired emotional responses. It’s all about psychology, dude.

Keep your prices in line with your competitors. Analyze, match, maybe even undercut them. Just remember, it’s all about understanding the playing field! Think about the market position and the product differentiation you want to explore. Check out our article on how to position yourself to get a competitive advantage.

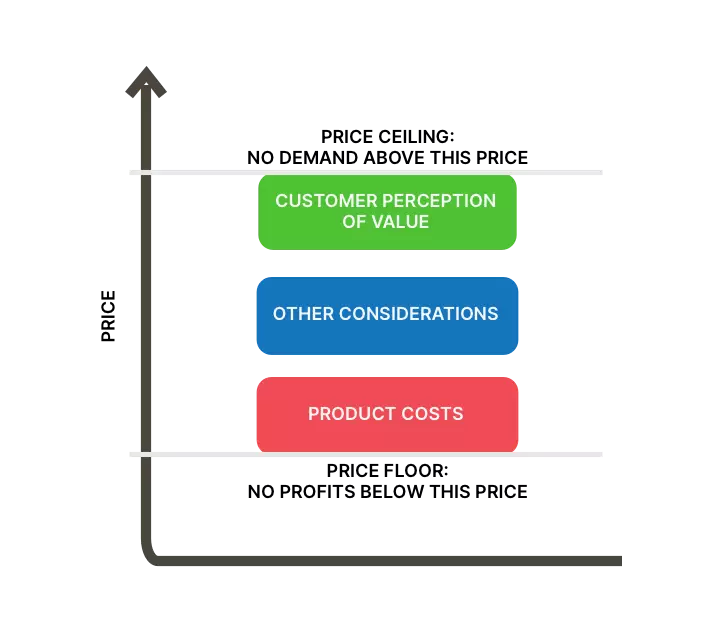

To help you find the right price to maximize profits, you need to bear in mind customer perception of value and product costs. Anything lower than the cost of producing the goods will mean zero profit, but anything higher than the customer’s perception of value and you won’t generate enough demand. The price has to be somewhere in the middle.

When sales issues arise, it’s better to think not about how to lower the price, but about how to increase the value. The perceived value of a product trumps its price. These are the three main strategies to find that sweet spot:

Ready to launch your product? Hold your horses. We have an amazing article on how to apply pricing strategies specifically to new product launches.

Here are some strategies used by your favorite companies, and how they make it work for them:

Start low, gain customers, then watch ’em flock.

Imagine a new yogurt company pricing their product below the market average to attract customers and break into the market.

High price first, then slowly bring it down.

Apple releases a new iPhone version at a high price and then lowers it over time. Tesla’s first vehicles were double what you would pay for one of their current models.

We have a great article on how price skimming might be the answer to your problems.

Set prices aligned with, or slightly below competitors, or offering additional incentives.

Airlines offering those slightly cheaper flights? Yup, that’s the move.

Get folks hooked on a little taste of your product.

Dropbox does it, and boom, new users don’t want to lose the service’s sweet benefits.

Charge more just because you can. Emphasize quality and exclusivity. Fewer sales, but who cares when the margins are killer?

Apple iPhones: 12% market share by units, 50% by revenue, 70% by profit.

The main gig’s cheap, but add-ons? Extra cost.

A risky strategy. If you cut the capabilities of the basic product, people won’t use it. If you make it acceptably functional, paid add-ons may not be needed.

Think digital PlayStation: cheap console but pricey extras.

Go rock bottom. Coupon services with discounts less than 50% don’t create an explosive effect.

Robinhood did it with zero commissions for stock trading, Revolut for currency exchanges. It’s wild out there.

Release two products: one cheaper, one pricier. It squashes competition stuck in the middle.

Johnnie Walker did it with their black and red labels. Genius.

Remember Zara suing Thilikó? They were rebranding Zara’s clothes and selling them at 8-10 times the price. Nuts, huh?

It’s all about the story and presentation. Position yourself as premium, and people will pay more. As they say, “as you name the ship, so it will sail.” Simple as that.

This is why your marketing goes hand in hand with your pricing strategy.

An item can cost exactly as much as you want to sell it for. Your product is worth more than you think! Charge higher to prove it’s better. Higher price = higher perceived value. Easy math.

If users are willing to pay more for a product, it demonstrates the product’s superior value. A higher price also allows startups to become profitable quicker. If a product is truly better, a higher price shouldn’t be a deterrent.

Don’t go wild trying every strategy. Pick what works for your business stage. Or else, analysis paralysis incoming.

The problem isn’t people not ready to pay. It’s you not offering what they’re willing to pay for. Provide value!

Consumers have fixed budgets. Identify the spending area your product inhabits and convince customers to shift their dollars your way.

Stand out. Aim for either low prices or high quality. Do not sit in the middle! Be more like Johnnie Walker.

Email subscription is available ONLY TODAY (oh, okay, and tomorrow).

Surely, we respect your inbox! Unsubscription works every day.

We’d love to tailor your experience — which of these best describes you?