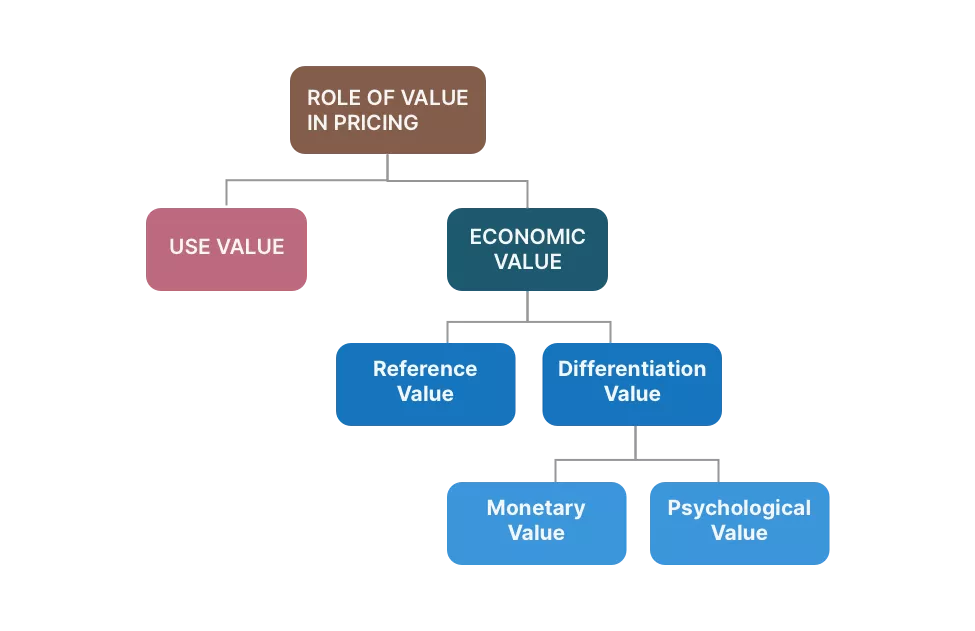

Value-based pricing is, as the name suggests, based on the value a good provides to a customer. The value at the heart of pricing strategy is economic value (or exchange value), not use value. Thus, to determine a proper value-based price, economic value estimation becomes important.

Economic value consists of reference value and differentiation value. That means the value that consumers attach to a product depends firstly on the available alternatives and their values (reference value). Secondly, the product at hand is differentiated from these alternatives and therefore captures differentiation value. Differentiation value comes in two forms: monetary and psychological. Both of these may be instrumental in shaping a customer’s choice but require very different approaches to estimate them. Monetary value represents the total savings or income increases that a customer accrues as a result of purchasing the product. Psychological value refers to the ways that a product creates innate satisfaction for the customer.

Thus, a product’s total economic value is calculated as the price of the customer’s best alternative (reference value) plus the worth of whatever differentiates the offering from the alternative (differentiation value). Total economic value is the maximum price that a fully informed, value-maximizing consumer would pay.

After having understood what economic value is, it is of course critical to approach economic value estimation strategically. How do you actually find out how much a product or service is worth to potential customers?

Economic value estimation begins by determining the price the next best competitor(s) charge(s). This becomes the reference value. For example, the reference value of a hotel room on a business trip is the price charged for the next-best hotel choice in town. In the case of a new iPhone, the reference value would be the price of the comparable Samsung or other smartphone under consideration.

Identifying the next best competitive alternative to your product and gathering accurate reference prices appears simple, but can be a challenging task in many cases. For instance, some products may not have a single competing product that customers would consider a suitable alternative. Instead, customers might construct a basket of different products and services as a viable alternative. In such a case, determining the reference price requires estimating an aggregate price for a comparable basket of goods.

Despite some possible challenges, this part of economic value estimation is fairly easy. The more difficult part is constituted by the estimation of differentiation value.

Differentiation value refers to the net benefits that your product or service delivers to customers over and above those provided by the competitive reference product(s). The traveler’s hotel of choice may provide a free breakfast and free cocktail hour not available at the next-best hotel. Competing products in a category likely provide many sources of differentiation value.

For effective economic value estimation, it is important to concentrate on those value sources having the most differentiation potential for a customer or market segment. For example, a free breakfast may not be an important value driver for a business executive on an expense account. But it could be a crucial factor for a traveler booking a hotel for a family vacation. The degree to which a firm differentiates its offer in terms of those needs will have the greatest impact on the price the firm can successfully charge above the reference value.

As indicated before, differentiation value is made up of a monetary value component and a psychological value component.

Email subscription is available ONLY TODAY (oh, okay, and tomorrow).

Surely, we respect your inbox! Unsubscription works every day.

We’d love to tailor your experience — which of these best describes you?