Did you know Tesco kicked off as a market stall in East London? Yup, it wasn’t always the gigantic retail beast we know today. Talk about humble beginnings! Fast forward to 2024, and Tesco PLC is a leading grocery retailer in the UK, serving millions of eager shoppers both online and in-store.

Ever tried building a business empire bigger than a double-decker bus? Yeah, Tesco’s been there, and done that! They’ve conquered the UK grocery scene and are now setting their sights on global domination. Still, it’s no walk in the park! The likes of Amazon, Lidl, Sainsbury’s, Aldi, Ocado, ASDA, and Morrisons are giving Tesco a run for its money. Retail war zone? You bet.

However, Tesco’s strengths such as its large market share and brand equity have contributed to the brand’s success, helping to give it a competitive advantage over its rival companies and making it a model for other companies in the industry.

Jack Cohen founded Tesco in 1919, it started as a small grocery stall in East London in 1919 and has grown significantly over the years expanding its product lines to include household items, groceries, electronics, and clothing. It has diversified into other sectors such as mobile phones, insurance, and financial services.

Tesco is headquartered in Hertfordshire, England, and currently operates 4,506 stores in five main markets; the UK, Slovakia, Ireland, Hungary, and the Czech Republic.

The company’s motto, “Every little helps,” denotes the company’s core purpose of “Serving our customers, communities, and planet a little better every day.” Little wonder it has become one of the most well-known British multinational grocery and merchandise retailers with a market capitalization of £24.43 billion (as of October 2024).

In line with its core purpose, the brand has been committed to continuously improving its services, offerings, and overall shopping experience for its customers. This has positioned the company in the retail industry as a household name known for its responsible and sustainable business practices and for offering value to its customers at affordable prices.

Let’s face it, Tesco didn’t become a retail rockstar by accident. They’ve got some serious strengths that make shoppers weak in the knees. How does Tesco stay ahead in the game? Let’s break it down, one strength at a time.

Retailers sell products and more products usually translate to more customers and of course, more revenue. Tesco’s got everything you could ever need (and probably a few things you didn’t even know you needed!). From fresh produce to electronics to clothing, they’re a one-stop shop for, well, pretty much everything!

Based on Tesco’s 2024 annual report, it generated sales of over £68 Billion. This huge revenue can be attributed to the brand’s product diversity, enabling it to cater to a diverse customer base.

In line with this, Tesco is the biggest grocery retailer in the UK, dominating the grocery retail market of Great Britain with a market share of 27.4% (as of April 2024). This is a prominent strength of Tesco because it has a larger market share than other retail brands in Great Britain like Sainsbury’s, Asda, and Aldi which have 15.3%, 13.4%, and 10% respectively.

Such market leadership enables Tesco to benefit from economies of scale and exert considerable influence over suppliers, further solidifying its position as the largest supermarket chain in the UK.

If you’d also like to generate £68 Billion one day… I have JUST the thing for you.

I’m talking about the 8D Framework To Launch Your Business – it’s a step-by-step guide that will show you exactly what you need to do to create a winning product, launch it, market it well, and grow your business into the sky.

(The £68 Billion might be a bit too ambitious to reach just with this eBook… but it’s a start!)

Companies are powerful when they are credible, trustworthy, and relevant. Tesco has got this in its bag; it is known for quality products and affordability, earning it a large and loyal customer base. This strength of Tesco facilitates the growth of the brand’s core grocery retailing business in the UK. Also, it aids the brand’s success in other business areas that it ventures into, such as non-food retailing, e-tailing, and financial services.

You know you’re doing something right when your brand has a club of its own. Tesco was the first European grocery store chain to release its Clubcard system in 1995. Being early in the loyalty card market gave it a competitive advantage; using the card as a marketing and promotional tool helped it understand customer behavior better and grow enormously in the retail industry, particularly in the UK.

Tesco’s Clubcard is classic magic, it is the VIP club of grocery shopping. You earn points, get discounts, and other special offers by exchanging your vouchers with Tesco Reward partners such as Disney+, Pizza Express, and Eurocamp. You feel all special and loved (who doesn’t love a good discount?). It’s a brilliant way to keep customers coming back for more, creating a sense of loyalty among them.

As of October 2024, Tesco Clubcard keeps 22 million UK customers coming back; that’s a big deal, even in retail. With this large customer base, Tesco easily collects valuable information that helps it learn and discover shoppers’ purchasing behavior. The management team uses this to improve the company’s marketing strategy and tailor its offerings according to customer’s preferences.

From a small stall in East London, Tesco has grown in leaps and bounds, currently having 4,506 stores based on its 2024 annual report. This large store network is a major strength because it allows the company to reach a broad customer base across different countries and regions.

Carrying out operations in multiple countries is beneficial because it reduces reliance on any single market and creates diversified revenue streams. This international presence gives Tesco a competitive advantage over its competitors that do not have a global presence because it enables the company to learn from different markets and apply best practices.

The brand’s customer base expands as new stores are added to the company’s operational chain in new markets. More customers mean more revenue which enables Tesco to negotiate better deals with suppliers, improving the company’s profitability.

There is no one-size-fits-all when it comes to shopping. Tesco understands this so well that they created different store formats to provide flexibility and appeal to a wider consumer base despite changing market conditions.

Tesco store formats include:

More stores = More customers = More revenue—that’s Tesco’s winning formula.

Supply chain hiccups? Not in Tesco’s book. The brand manages its supply chain through vertical integration, lean thinking, and complexity management. Its supply chain is structured to minimize costs, maximize efficiency, reduce waste, improve inventory management, and quickly respond to changes in demand.

Tesco has profitable relationships with suppliers, which help minimize supply chain risks and ensure quality by reducing incurring costs and implementing efficient waste management. It ensures that products are delivered to customers promptly, thus reducing waiting times and increasing customer satisfaction.

Having such an efficient supply chain management system is one of Tesco’s strengths because an efficient supply chain ensures product availability in stores, ensuring customers receive their orders promptly without hassle. This, in turn, creates high levels of customer satisfaction and maintains competitive pricing, increasing the company’s profit.

One of Tesco’s strengths is its use of technology in optimal ways to enhance its customers’ shopping experience. Checkout lines are great—if you happen to have an unnecessary surplus of time but if you don’t? Tesco’s online platform is user-friendly and accessible to customers worldwide, thus expanding its customer base and increasing its revenue streams.

The growth of e-commerce and changing consumer behaviors due to the 2019/2020 pandemic, has contributed a 60% growth in Tesco’s online sales compared to pre-COVID. Consumer’s use of its online platforms enables Tesco to collect data on customer behavior and preferences, which it uses to improve its product marketing strategies and offerings.

For example, the company has effectively used data analytics and AI technology to personalize promotions and recommendations and to provide a tailored shopping experience to customers. Such innovative marketing approaches enable the company to stay ahead of the competition in the industry.

Another way Tesco uses technology is through its presence on social media platforms like TikTok, Facebook, Instagram, and X (formerly Twitter), increasing the brand’s reach and awareness.

Digital marketing is done on the company’s social media platforms to compel its audience to purchase. The brand also uses various innovative marketing campaigns to engage with customers via several channels including in-store promotions and email marketing.

Some examples of noteworthy campaigns by Tesco include #TescoVoiceOfCheckout, Better Baskets, Prices that take you back, and Whoosh.

Tesco uses an RFID-enabled barcode system to track the movement of its products from its suppliers, distribution centers, and stores, helping them better manage inventory and avoid stockouts. The integration and use of data analytics and artificial intelligence further guide decisions on inventory management to ensure available products align with customer preferences.

The brand also advanced its M-commerce facility and mobile payment app. It integrated technology into its operations through its online platform and mobile apps to make shopping more convenient and better for customers. This has helped to enhance customer engagement and loyalty.

An additional strength of Tesco is its highly trained staff. The brand focuses on training its employees to ensure a high standard of service is maintained across all its divisions. The company employs over 330,000 people worldwide and provides comprehensive training to equip them with the skills and knowledge needed to provide excellent customer service.

Employers know that employee turnover is one of the top challenges in any industry. To reduce employee turnover, Tesco offers a conducive working environment and benefits package that supports employee well-being and development. The brand calls its employees colleagues, giving them a sense of comradeship, and pays them £12.02 per hour, which is one of the top pays in the retail industry within the UK.

Colleagues at Tesco have career progression opportunities, which include training and development programs. This enables them to develop new skills and advance in their careers, motivating them to stay with the company for a long time.

Tesco PLC also offers a range of healthcare benefits, such as mental health support and medical insurance to ensure its staff have access to the care they need. Colleagues are also entitled to 26 weeks of paid kinship leave.

These and many other benefits that Tesco offers are part of the brand’s strengths because low employee turnover helps to streamline the company’s operations. Plus, happy employees result in better customer service which consequently provides a better consumer experience thereby increasing customer satisfaction, sales, and customer loyalty.

Tesco’s commitment to sustainability attracts environmentally-conscious customers and creates a positive image for the company. The brand integrates sustainability initiatives like using renewable energy, reducing food waste, and the Green Clubcard Points program.

For instance, the Green Clubcard Points program offers green points to shoppers who reuse carrier bags. Such initiatives show the company’s commitment to sustainability and reducing its carbon footprint.

Apart from protecting the environment through such initiatives, it also reduces costs and aligns with the values of many of its stakeholders and investors. It also helps Tesco comply with regulatory requirements and manage the risks associated with environmental and social issues.

Tesco’s commitment to sustainability and social responsibility also reinforces its brand image, aligning with many customers’ values thus being a major strength, especially with more individuals and organizations advocating for sustainable use of resources. Thus, establishing Tesco as a reputable and reliable brand.

Tesco’s private label products contribute to its success in the retail industry. The brand has its factories and makes some of its groceries. This means it doesn’t have to depend on external suppliers for these products which saves costs and makes its products cheaper. This form of backward vertical integration means the brand doesn’t have to depend on external suppliers for some products, saving costs and making its products cheaper.

The company has private label brands such as Tesco Finest, F&F, Tesco Everyday Value, Tesco Standard, and Tesco Healthy Living which offer high-quality goods to customers at competitive prices.

These brands count as Tesco’s strengths because they help to differentiate the company from competitors and boost its profit margins. It further aids Tesco to offer high-quality products at affordable prices; attracting price-sensitive customers who seek value for their money and increasing the company’s profitability.

Tesco has an experienced leadership team with a proven track record of success. This makes Tesco very successful because it helps instill confidence in investors, customers, and employees. Aside from this, the team is skilled at navigating complex regulatory and legal environments. Hence, this experienced leadership team is one of Tesco’s strengths because the team helps the company avoid potential pitfalls or legal issues.

Despite being largely used only in the UK, Tesco’s Credit Card System gives the company a competitive advantage in the retail industry. The company introduced a good credit system for shoppers, paired up with a credit card wherein partial payments are deducted monthly for those who cannot afford to pay for a purchased electronic device in one payment.

This is one of Tesco’s strengths because it attracts more shoppers, especially those who need electronics but do not have the full amount to purchase them. It also increases customer loyalty by making them feel that the brand has their best interest at heart.

Another strength of Tesco is its diversified business model which provides the company with multiple sources of revenue. This diversification of revenue streams enables the company to reduce its dependence on the retail sector and increase its profitability.

A diversified source of income is one of the strengths of Tesco because it helps mitigate risk and protect the company when navigating economic downturns. It also allows the company to cross-sell its products and services to its existing customer base, which boosts sales.

Apart from retail business, Tesco has other streams of revenue such as Tesco Bank, which include banking and insurance. This offers its customers additional convenience. Other revenue streams and subsidiaries of Tesco include Booker Group, Tesco Mobile, and Tesco Tech Support.

Even the mightiest of giants have their Achilles’ heel (or should we say, Achilles’ shopping cart?).

Sainsbury’s, Morrisons, and Asda are Tesco’s biggest competitors. These three companies including Tesco account for about 66% of the market share in Great Britain. Each of them is in strong competition and has certain advantages due to one another’s weaknesses and challenges.

Nevertheless, the unique thing about Tesco is that, based on its core value, the company ensures that it addresses its weaknesses over time.

Home is where the heart is, but Tesco’s heart is too tied to the UK. Despite Tesco’s international presence, most of its revenue comes from the European market because the company has been unable to adapt and operate in markets outside of Europe.

Although Tesco is the biggest grocery retailer in the UK market, its over-dependence on it makes the brand vulnerable to certain factors like increased competition in the domestic market, changing consumer preferences within the region, and economic fluctuations which could negatively impact its profitability.

Tesco undoubtedly has higher sales and revenue than other retailers in Great Britain due to its successful operations and large customer base in the European market. However, Tesco’s weakness of depending too much on the UK market limits the company’s potential for growth and expansion in other markets.

To overcome this weakness, the company has to explore opportunities for growth in emerging markets by conducting market research and market potential analysis. An important element when expanding into new markets is finding the right local partner who understands the market’s peculiarities.

The company can partner with firms in other countries familiar with the local market dynamics and establish a structure that mutually rewards them while ensuring long-term success. This way, Tesco can avoid the recurring closing of its international operations as has occurred in the United States, France, South Korea, Japan, Poland, Thailand, Malaysia, and Turkey.

Tesco also needs to diversify its product offerings to cater to different purchasing habits in other countries. It can customize its offerings to a market by understanding the market dynamics and specifics and considering other factors like cultural and sociopolitical differences.

Another weakness of Tesco is price competition. Discount retailers Lidl and Aldi are playing hardball with pricing and have successfully attracted cost-conscious customers thus causing stiff competition for Tesco.

This stiff competition pressures Tesco’s profit margins and as a result, the company tends to lower prices or increase promotional activities to maintain its market share. This, in turn, happens to be one of the factors that affect the company’s profitability.

To tackle this weakness and stay competitive, the brand can adopt a more customer-centric approach, like improving its in-store experience, offering personalized products and services, and leveraging its brand strength and loyalty programs.

It can also explore collaborations and partnerships with other retailers or firms to expand its customer base and market reach ahead of rivals like Aldi and Lidl.

As a large multinational corporation, Tesco has a complex organizational structure that is designed to meet the needs of its diverse customer base and support its global operations.

Although sorting work into departments aids efficiency, it tends to hamper communication especially when the organizational structure includes whole divisions separated by distance. Once communication is hampered, coordination tends to suffer too.

Having a complex organizational structure is not necessarily a bad thing, the only issue is that it could lead to slower decision-making, inefficiencies, and challenges in implementing changes across different business units.

Nevertheless, decentralizing can improve decision-making by delegating authority to the lowest levels possible. This gives room for those who are closest to a situation to make decisions. For instance, a front-line employee can make a spot-on decision for the company’s betterment instead of relying on or waiting for a supervisor.

Tesco has its businesses in many locations and as a result, the head office is reasonably unable to control or make decisions for all the locations. Hence, to cover some of Tesco’s weaknesses that come with the complexity of its organizational structure, the company uses a decentralized organizational structure wherein lower levels of the business have decision power.

Tesco’s delivery service has hit a few bumps, leading to disgruntled customers. Shopper complaints are stacking higher than a Tesco Express shelf! For example, sometime in January 2024, many Tesco home delivery shoppers saw their orders canceled, due to a system issue. BBC even reported the problem.

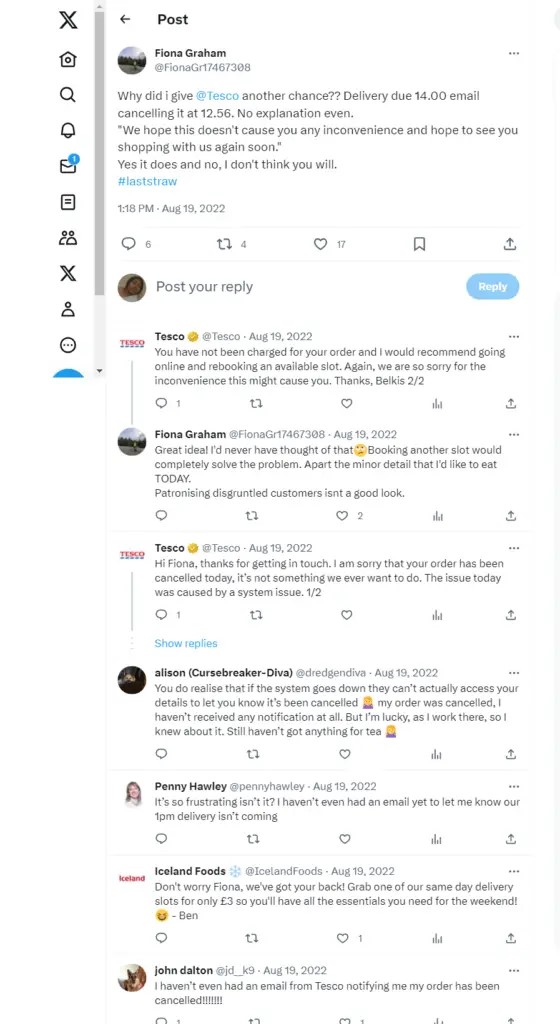

The supermarket chain apologized, saying the problem was caused by a technical issue, and urged customers to rebook. However, in anger, many customers had taken to social media after Tesco customer services contacted them over the problems.

Hitches with delivery service are one weakness other retail companies can exploit. For instance, when a similar delivery hitch occurred in August 2022 and a lot of customers took to social media to complain about the issue, another British supermarket chain, Iceland Foods, took advantage of the situation to advertise its discounted online delivery service under a customer’s post on X in an attempt to convert some of Tesco’s disgruntled customers as seen in the screenshot below

.

.

This shows that if Tesco doesn’t address this weakness properly, the company will lose its customers to other retail brands with better delivery services; fewer customers means fewer sales, which will affect the company’s profit margin.

To address this weakness, Tesco needs to invest in its logistics capabilities by adopting more efficient delivery models through partnering with third-party logistics providers and using data analytics to optimize delivery routes. It can also improve its customer service by offering compensation to customers for late or canceled deliveries and providing real-time updates on delivery times.

Tesco is always looking for new high-quality products from brand-new businesses or well-established ones. The company has a profitable relationship with its suppliers, giving them a great opportunity to share their products with Tesco’s customers across the nation.

Nevertheless, Tesco’s reliance on suppliers for most of its products is one of its weaknesses. This is because high dependence on suppliers for products makes the company vulnerable to supply chain disruptions and shortages, affecting product availability and sales.

To mitigate the risk of supply chain disruption, Tesco can invest in stronger relationships with its suppliers through strong strategic partnerships and retail concessions like Target does. Target has a competitive advantage through the shop-in-shop concept that it implemented where it partners with strong brands like Starbucks, Apple, Disney, and Ulta Beauty.

Tesco can also diversify its supplier base and adopt backward vertical integration. Implementing a backward integration strategy may be capital-intensive but it has its benefits. Since Tesco has its factories and already makes some of its groceries, it can expand and integrate manufacturing more of its products into its supply chain to reduce its dependence on external suppliers to the bare minimum.

This strategy would enable the company to avoid being totally at the mercy of external suppliers. It would also save costs and make its products cheaper. Kroger’s supply chain, for instance, uses this strategy to stay ahead of the competition in the retail industry.

Also, Tesco can use data analytics to monitor and predict changes in demand and supply to avoid a product shortage and implement risk management strategies, such as contingency plans for supply chain disruptions.

Criticism regarding supplier treatment has cast some shade on Tesco. The company has been accused of using its buying power to negotiate lower prices from suppliers which has pressured suppliers to cut costs.

Also, according to a March 2023 BBC report by BBC, Tesco requested its suppliers to pay a new fulfillment fee when the company sells its products online. According to the retail chain, the new charges were needed to help the company cover the expenses of serving more online customers. This news, however, was not received well by some suppliers. Some business retail consultants have criticized this move to be “outrageous”.

The new charges were part of the reason the company experienced supplier price increases. Hence, there were more gaps on the supermarket shelves as the company was not accepting price increases from suppliers.

Tesco’s investment in new store formats has been lackluster, leaving room for competitors to swoop in and snatch the limelight. Tesco’s dependence on large physical stores and lack of investment in new store formats has made the company less agile and innovative. Hence, losing customers to competitors that are more flexible and dynamic.

Changing shopping habits is one of the problems faced in the retail business. Thus, traditional brick-and-mortar retailers like Tesco will likely face declining foot traffic and reduced sales due to the rise of e-commerce and online shopping.

For instance, Tesco’s reliance on physical store locations limits its ability to compete with online retailers like Amazon which has greater flexibility and lower overhead costs. Online retailers have disrupted the traditional retail model, and Tesco seems to be at a disadvantage due to its slow adoption of digital innovations.

The trend towards smaller, more frequent grocery trips also affects the company’s operations and logistics. Due to the changing consumer preferences towards online shopping and smaller local stores, Tesco’s larger store formats, like Tesco Extra and Tesco Superstores have faced challenges.

This is because consumers increasingly demand convenient and personalized shopping experiences, which the company’s traditional larger store formats cannot provide. Adapting new store formats and managing underperforming stores have been some of Tesco’s challenges and weaknesses because such operations take time and effort.

Tesco’s failed ventures in foreign markets highlight the brand’s weakness in expanding and maintaining a presence in diverse markets and competitive landscapes. When expanding to other markets, a company has to adapt its strategies to fit the regulations and conditions of a local market which involves significant investment.

Tesco’s overseas ventures haven’t exactly been sunshine and rainbows. Cultural missteps, logistical challenges, regulatory hurdles, and high costs have taught Tesco harder lessons than expected.

For instance, the company’s poor market performance in the US was due to its failure to maintain its stores and services. It had small store formats, poor store locations and its effort to adjust its foods to fit the American public’s lifestyle didn’t work out. As a result, Tesco lasted only five years in the States, sold its stores, and exited the US market in 2013.

Tesco also expanded and failed into several Asian countries, like Japan, China, Thailand, Malaysia, India, and South Korea, citing high trading costs, customer demands, and financial problems. The company left Japan in 2011 after nine years. The Japanese market was challenging for the company’s trade because, despite its monumental investment, it was still unable to win Japanese consumers over.

Tesco also failed to gain a large enough market share especially. because most Chinese people would rather shop online than do walk-in stores. Nevertheless, to succeed in foreign markets, Tesco needs to adopt a more localized approach, like tailoring its product offerings to local preferences and tastes.

The company might need to partner with local suppliers and businesses, engage with local communities and stakeholders, and build strong relationships with local governments and regulators. Also, thorough market research and due diligence should be conducted before entering new markets.

Regulatory compliance is one of the challenges Tesco faces. The company operates in a highly regulated industry with strict rules regarding food safety, employee rights, and environmental impact. Hence, it must constantly ensure it monitors and adapts to regulation changes, which can be time-consuming and costly.

Many environmental campaigners are skeptical about the willingness of major companies like Tesco to cut emissions, claiming it’s a PR exercise. However, Tesco claims it has already made changes. The company, for instance, has introduced unwashed potatoes that have a longer shelf life, turned to vertical strawberry farming to cut water usage, and launched reusable packaging.

Tesco has also electrified its home delivery vehicle fleet and increased recycling of soft plastic packaging that usually ends up in landfills. The company has set out plans to use renewable energy, reduce plastic usage, and encourage more sustainable diets to hit a net-zero carbon target by 2035.

Nevertheless, a persistent weakness of Tesco and others is the negative publicity from environmental campaigners surrounding their CSR initiatives.

Many social and environmental campaigners complain that companies are not implementing enough CSR activities. This affects the company’s ability to attract and retain talent and consumers, especially the younger generations that prioritize social and environmental values.

These days, consumers are more environmentally oriented, and to stay competitive, Tesco has to capitalize on these market trends. This has been a challenge for the company because failure to address sustainability issues in its supply chain causes legal and financial consequences, like lawsuits, fines, or reputational damage. This could affect the company’s long-term viability and decrease investor confidence.

The head of Tesco, Ken Murphy in an interview stated that investors and customers want supermarkets to improve their environmental credentials but are not prepared to accept lower returns or higher prices as a trade-off. He mentioned that to navigate the shift to net-zero emissions, the company had to strike a balance, for instance, reducing the use of plastic packaging without increasing the food waste that might follow.

According to Murphy, there is always a small proportion of very committed customers who are willing to pay higher prices for more sustainable goods. At the same time, the vast majority are not willing. Even investors insist that retail chains increasingly focus on environmental goals but do not want to see a lower return on their investment. Hence, the company is constantly juggling these priorities and, hopefully, trying to do a decent job.

To solve this challenge, the company should implement more concrete actions and measurable results to prove its commitment to sustainability and ethical sourcing. It should also engage in meaningful dialogue and collaboration, involving its stakeholders in its CSR decision-making processes.

Also, to gain trust and loyalty to the brand, the company should be transparent toward its customers and communicate everything it does towards ethically sourcing its products. The brand can also provide a more comprehensive selection of healthy, eco-friendly, and organic products.

Lastly, as much as Tesco boasts rigorous quality control measures, it should consider any disturbing customer complaints as an indication of room for improvement.

Hello, fresh horizons! Where can Tesco go from here?

Expanding to new markets is a top opportunity for Tesco. Many emerging economies and continents with large populations such as Africa and South America will be good markets to venture into because it will significantly expand the company’s existing customer base, increase revenue, and lead to greater brand recognition across the globe.

Tesco can then leverage the increased brand recognition to clinch wholesale deals and strategic partnerships with existing retailers that are already well-known in various international markets such as ShopRite, JD.Com, Al Shaya, and FEMSA. Through this global expansion and wholesale deals, Tesco will diversify its income streams and risks by no longer relying solely on sales from its UK and European operations.

As the competition to secure the bag becomes stiffer, one area of opportunity for Tesco is appealing to new consumer segments such as environmentally conscious individuals and vegetarians through special campaigns and new offerings.

To halve the impact of food production on the environment, the brand committed to a 300% increase in its sales of meat alternatives by 2025 and so far, the brand has rolled out several plant-based meat alternatives. This move appeals to both environmentally conscious patrons and vegetarians, thereby adding a new crop of consumers to the brand.

Tesco can further curate more market segmentation strategies in its product offerings to appeal to more market segments since it already offers a wide range of products.

For example, the brand can create specialized stores that are focused on selling particular products such as organic or vegan stores; such specialized stores will cater better to these consumer demographics.

Price matching Aldi is one opportunity that Tesco has grabbed head-on. By price-matching several products as its top competitor in the UK market, the brand is clearly communicating to its price-sensitive consumers that they have their interest at heart and are dedicated to providing them value for their money. This has helped increase consumer retention and satisfaction.

Tesco has had its fair share of delivery mishaps over the years so its forward vertical integration into offering one-hour delivery services through Whoosh is a step in the right direction. This delivery option not only meets consumer demands for faster delivery time but also grants the company greater control over its last-mile logistics, helping it to effectively serve its customers beyond the four walls of its stores.

The race isn’t over. Dark clouds loom for Tesco in the form of geopolitical unrest and fierce competition.

Expansion into international markets comes with its fair share of complexities and threats. As Tesco expands into more markets, the geopolitical climate represents ongoing challenges, and Tesco is bravely trudging through it.

For example, the Brexit Referendum posed considerable threats to Tesco as the UK’s exit from the European Union has increased import costs and more complexities in logistics. This is just one out of many geopolitical events that can impact the brand,

Intense competition from other retailers like Sainsbury’s, Amazon, ASDA, Aldi, and Lidl is one of the threats Tesco faces. Every retailer wants a piece of the pie and it often results in reduced profit margins, price wars, and decreased market share.

For instance, humongous online retailers like Amazon, have potentially stolen market share from Tesco’s online delivery service.

Economic downturns, such as recessions, are also a challenge for Tesco because they can lead to decreased consumer spending, which could affect Tesco’s net income.

For instance, in October 2022, the head of Tesco, Ken Murphy, told reporters that customers were increasingly concerned about household spending and watching every penny to make ends meet. He mentioned that households were shopping less online, and making more shopping trips, but with smaller basket sizes.

Navigating through economic downturns is a major problem in the retail industry because it makes it more difficult for companies to secure financing for investments in new technology or expansion. Economic challenges also cause inflation and supply chain disruption, leading to increased costs for the company.

For instance, for the year 2022/23, Tesco reported a 6.9% decline in its adjusted operating profit across its bank and retail business. This is due to the unprecedented inflation in the prices that the company paid its suppliers for their products and the cost of running its operations.

Economic downturns and changing consumer preferences are huge threats to Tesco because once the company can not keep up with managing costs and evolving trends, it loses market share to other retail brands.

Disruptive technologies are one of the technological factors affecting Tesco. Emerging technologies like blockchain, automation, and artificial intelligence can potentially disrupt the company’s supply chain and operations. This is a challenge because implementing and adopting new technologies can be expensive.

To digitally transform its operations, the company has to invest hugely in big data, artificial intelligence, and cloud among other disruptive technologies. Its annual ICT spending was estimated at $1.9 billion for 2023.

Tesco is forced to keep adopting technology to stay competitive because if these technologies are not adopted by the company but adopted by its competitors, they become a threat to Tesco because it can lead to decreased efficiency and competitiveness.

Every existing company has strengths, weaknesses, opportunities, and threats; a business’ success or failure depends on how well it leverages these strengths and opportunities while mitigating its weaknesses and threats to the barest minimum.

Tesco’s commitment to continuously improving its offerings, services, and the overall shopping experience for its customers has been a main contributor to the brand’s unmatched position as the leading market share holder in the UK. Its journey is full of valuable lessons for any business, big or small. This includes:

Tesco’s story is one of resilience and reinvention. Use its strengths as inspiration, its weaknesses as lessons, its opportunities as signs, and its threats as pitfalls to avoid. Whether you’re shopping or strategizing, these insights keep you on your toes!

Email subscription is available ONLY TODAY (oh, okay, and tomorrow).

Surely, we respect your inbox! Unsubscription works every day.

We’d love to tailor your experience — which of these best describes you?