Let’s be real: Ford has been driving through some bumpy roads lately—especially when it comes to their supply chain. Electric vehicles, sustainability goals, and good old operational efficiency have thrown some serious curveballs their way. But here’s the kicker: despite these challenges, Ford’s still cruising forward, and there’s a lot we can learn from them.

Now, you’re probably thinking, “What do I have in common with a giant like Ford?”

OK, maybe you’re not producing electric trucks, but hear me out—efficiency, cost control, and adapting to market changes? Yeah, that hits close to home, doesn’t it?

Ford’s challenges may be super-sized, but the lessons they offer can help even the smallest businesses steer their way through tough times.

So, let’s dive into Ford’s supply chain rollercoaster and see how their strategies can help you fine-tune your own business operations—without needing a billion-dollar budget.

Ah, the auto industry—it’s like trying to turn a cruise ship in a kiddie pool. Ford’s been juggling a lot lately, and their supply chain is feeling the heat. With tech evolving faster than your favorite phone getting outdated and customers switching preferences like they’re picking a new Netflix show, Ford’s been in a bit of a scramble to keep up in the auto biz, where everything is super complicated and costs a fortune.

Let’s talk about Ford’s big electric gamble—the F-150 Lightning. Ford went all-in, thinking, “Everyone’s gonna love this!” But, as it turns out, predicting demand for a brand-new, all-electric pickup truck is trickier than finding a good parking spot at the mall on Black Friday.

Sure, the Lightning’s cool, but the numbers? Not so much. Ford’s electric division, Model E, is singing the blues, with a sales drop of 26% in early 2024. The company expects a full-year loss of $5-5.5 billion for Model E.

The F-150 Lightning? Yeah, its sales are moving slower than a tortoise on a lazy Sunday, hitting just 4,400 units in November. So, Ford decided to cut its production plans for 2024 by half—talk about a reality check!

And if that wasn’t enough, they’ve scrapped or postponed $12 billion in EV investments because they’ve been losing about $60,000 on each electric vehicle sold. They even had to dial back their dealer EV program after some legal hiccups and a drop in dealer sign-ups.

On top of that, they’ve trimmed their battery plant plans in Michigan by more than 40%, pushed back the launch of their big electric pickup to 2027, and canceled an SUV. It’s like trying to predict the weather in Texas—good luck with that!

Consumer preferences for EVs are all over the place. Sure, people want to save the planet and cash at the pump, but they’re also worried about sky-high prices, range anxiety (will I make it?), and where on Earth they’ll charge these things.

For Ford, it’s a constant balancing act: make enough cars to keep customers happy without going overboard and ending up with a lot of unused metal sitting around.

Ford’s supply chain is like a game of Twister with all its global suppliers—one wrong move and everything gets tangled. With the shift to electric vehicles, they need batteries and techy bits that are way different from traditional car parts.

This means suppliers are feeling the pinch too—many aren’t ready to ramp up quickly. And when demand doesn’t match expectations (looking at you, F-150 Lightning), Ford has to scramble to adjust its game plan.

For small businesses watching this unfold? Take notes! The market can be as unpredictable as your uncle at Thanksgiving dinner. Stay flexible and ready to pivot your products or supply chain strategies whenever necessary!

Decarbonizing Steel and Aluminum Supply Chains

So, Ford joined the First Movers’ Coalition back in 2022, promising to clean up its steel and aluminum supply chains. Fast forward, and… well, let’s just say progress has been a little slower than we all hoped.

In fact, the company’s latest sustainability report doesn’t exactly scream “Game-changer!”—no shiny new deals with suppliers to cut carbon emissions. Analysts were waiting for Ford to roll up with something big, but instead, it feels like we’re still stuck in neutral.

The good news? Ford’s been doing a decent job reclaiming aluminum from transmissions and engines. The bad news? They’ve been recycling aluminum like this for a while now, and the numbers aren’t really changing—even though they sold more cars in 2023. It’s like bragging about running a mile, but you’ve been at the same pace since last year.

The Demand for More

Now, don’t get us wrong—Ford’s making some strides. But according to the eco-advocates over at the Lead the Charge network, it’s not enough.

In March 2023, people started raising eyebrows over deforestation and environmental issues in Brazil’s Amazon, all linked to the ore mining that helps make the aluminum for—yep, you guessed it—the F-150 Lightning. But instead of tackling these concerns head-on, They kinda dodged them in their sustainability report.

Experts are saying, “Come on, Ford, it’s time to put the pedal to the metal on sustainability!” They want more action, clearer timelines, and some actual agreements with suppliers to clean up the mess.

If the company really wants to lead the pack in green manufacturing, they’ll need to pick up the pace. Otherwise, they might find themselves lagging behind in the race to go green.

Ford Motor Company faces several operational efficiency challenges within its supply chain that impact its overall performance.

Outdated IT Infrastructure

One of Ford’s big headaches? Their supply chain tech is stuck in the past—kind of like trying to stream the latest blockbuster on a dial-up connection.

A lot of their suppliers, especially the first-tier and lower-tier ones, are running on outdated IT systems. And as you can imagine, that causes a whole bunch of problems: miscommunications, bad coordination, longer wait times, and, of course, higher costs. It’s like trying to organize a group text when half the people are still using flip phones.

Ford’s using the Just-in-Time (JIT) inventory system to keep storage costs down and parts arriving right when they need them. Sounds great—except when your suppliers’ tech is so slow, they can’t keep up.

When those real-time updates are more like “whenever-we-get-around-to-it” updates, production halts faster than you can say “supply chain nightmare.” It’s like trying to run a relay race when your teammate is stuck tying their shoes.

Complexity of Transitioning to Electric Vehicles (EVs)

As Ford moves from gas-guzzlers to battery-powered rides, they’re finding out it’s not just a matter of swapping engines.

EVs need a whole new set of parts, especially those precious batteries, which means dealing with specialized suppliers, new production methods, and logistics that Ford probably didn’t see coming. So yeah, it’s not like they can just copy-paste their current supply chain setup for EVs.

Managing two supply chains—one for old-school combustion engines and one for shiny new EVs—is like juggling two completely different jobs at once. And let’s just say, things aren’t exactly running like a well-oiled machine yet.

Building an EV is still more complicated (and expensive) than putting together your classic gas-powered car. It’s gonna take some time for Ford to work out the kinks and get those EV production lines running like clockwork—or at least something close to it.

Ford Motor Company faces significant challenges related to stiff competition within the automotive industry, which directly impacts its supply chain operations. This competition comes from both traditional automakers and new entrants, particularly in the electric vehicle (EV) market.

Pressure to Reduce Costs

As competition intensifies, especially from companies like Tesla and other EV manufacturers, Ford is under constant pressure to reduce production costs while maintaining quality. This pressure leads to demands for cost reductions from suppliers, which can strain relationships and affect the overall quality of materials and components.

For instance, Ford has requested its suppliers to find ways to enhance manufacturing efficiency and reduce capital expenditures, particularly in its Model E division, which focuses on electric vehicles.

Need for Rapid Innovation

One of the biggest areas of competition for Ford comes from its shift toward electric vehicles. Companies like Tesla, Rivian, General Motors, and even traditional competitors like Toyota and Volkswagen are all competing fiercely in the EV space.

Tesla, for example, is recognized for its advanced battery technology, efficient production processes, and robust supply chain for EV components. This puts pressure on Ford to innovate and scale up its own EV supply chain to remain competitive.

For Ford, this means:

Since competitors are quickly introducing new models with advanced features, including connectivity, autonomous driving capabilities, and enhanced performance; Ford must innovate rapidly to keep pace, which requires agile supply chain operations capable of adapting to new technologies and design changes.

This need for speed can strain existing supply chains that may not be equipped to handle frequent shifts in production requirements.

So, Ford’s trying to keep up with the ever-changing whims of car buyers—especially in the wild world of electric vehicles (EVs). What’s their secret sauce? Effective Market Segmentation!

Basically, they’re trying to figure out what makes each type of customer tick, so they can serve up the perfect EV, whether you’re a budget-conscious shopper or someone who wants every bell and whistle possible.

It could segment the EV market based on factors such as:

By getting into the heads of different customer types, Ford can whip up targeted marketing campaigns and roll out a lineup of EVs that hit all the right notes. That way, they can keep everyone—from the penny-pinchers to the planet-savers—happy and cruising.

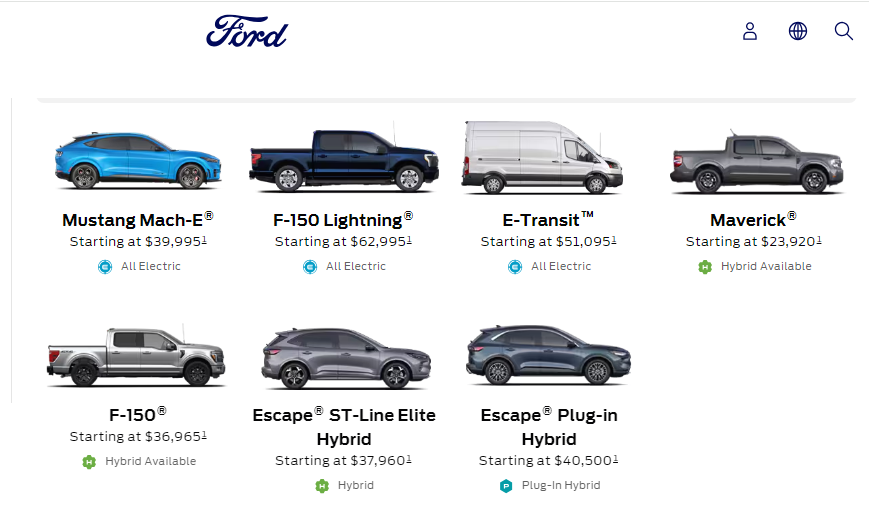

For example, Ford plans to introduce a variety of electrification choices across its vehicle lineup, including:

This diversified approach aims to provide customers with more affordable EVs and hybrids that meet their needs across different vehicle segments.

The company is also optimizing its battery sourcing and production to reduce costs and support its expanded EV lineup.

Key initiatives include:

By making batteries more affordable, Ford can pass those savings on to customers in the form of lower EV prices.

To further reduce the cost of its EVs, Ford is retiming the launch of its groundbreaking electric truck, codenamed “Project T3“, to the second half of 2027. This allows the company to incorporate learnings from the F-150 Lightning and take advantage of anticipated advancements in battery technology.

The company is also writing off $400 million related to manufacturing equipment for previously planned all-electric three-row SUVs that it will no longer produce, instead offering hybrid versions.

By adapting its product roadmap and manufacturing footprint, Ford aims to deliver a capital-efficient and profitable electric vehicle business that meets evolving customer demands.

Reduction of Greenhouse Gas Emissions

Ford has committed to achieving carbon neutrality across its vehicles, operations, and supply chain by 2050. This commitment has led to substantial investments in reducing emissions:

Ethical Sourcing of Raw Materials

Ford recognizes that sourcing materials sustainably is crucial for reducing the lifecycle emissions of electric vehicles (EVs):

This case study, Nestlé’s Supply Chain, offers a detailed analysis of Nestlé’s supply chain, highlighting both their successes and challenges in managing ethical and sustainable practices. It also provides Nestlé’s approach to ethical sourcing and child labor prevention.

Ford can learn from some of the resolutions from Nestlé’s experience with sustainability challenges.

Collaboration with Third-Party Organizations

To enhance sustainability practices, Ford collaborates with various third-party organizations:

Partnerships for Responsible Mining: Ford works with initiatives like the Initiative for Responsible Mining Assurance and the Responsible Minerals Initiative to address environmental and human rights issues within its supply chain.

The company has joined platforms such as Manufacture 2030, providing tools for its suppliers to measure and manage their carbon emissions effectively.

Ford has made important progress in ensuring respect for the rights of Indigenous Peoples and workers in its supply chain. The company now has a policy explicitly referencing the UN Declaration on the Rights of Indigenous Peoples and requiring suppliers to obtain Free, Prior, and Informed Consent (FPIC).

It has also updated its human rights policy and conducted audits of its nickel, lithium, and cobalt supply chains.

Investment in Sustainable Technologies

Ford is investing heavily in technologies that promote sustainability.

The company plans to invest $50 billion between 2022 and 2026 to develop EVs and batteries, focusing on sustainable production methods. For instance, Ford’s collaboration with PT Vale Indonesia aims to secure a sustainable nickel supply through innovative processing techniques that enhance recovery rates while minimizing environmental impact.

Ford Motor Company is actively addressing the challenges posed by stiff competition in the automotive industry, particularly in the electric vehicle (EV) market. The company is implementing a multifaceted strategy that focuses on vertical integration, innovation, and adapting to market demands.

Comprehensive Guide on Vertical Integration – this article provides valuable insights into the importance of vertical integration, a strategy that Ford is adopting to improve its competitiveness in the electric vehicle market.

Here’s how Ford is navigating these competitive pressures:

Investing in Vertical Integration

Ford is heavily investing in vertical integration for its electric vehicle production, aiming to gain greater control over critical components, especially batteries. This strategy mirrors the successful approach taken by Tesla to gain a competitive advantage in the industry.

By producing key components in-house, Ford seeks to reduce its reliance on external suppliers, which can be vulnerable to disruptions and capacity constraints.

Enhancing Manufacturing Facilities

Ford is committing substantial resources to upgrade its manufacturing facilities to support its EV strategy. The company plans to invest over $11 billion globally, with a significant portion dedicated to retooling North American plants for electric vehicle production.

A notable investment includes the establishment of a new assembly plant at Ford’s Rouge complex in Dearborn, Michigan, specifically designed for producing an all-electric version of the F-150 pickup truck. This facility will enhance Ford’s capacity to meet the growing demand for electric trucks while ensuring high-quality production standards.

Ford is also refurbishing its older plants, such as the Van Dyke Transmission Plant in Michigan, to produce e-motors and e-transaxles. These upgrades are crucial for supporting the new generation of electric vehicles and improving overall manufacturing efficiency.

Strategic Partnerships and Joint Ventures

Another key aspect of Ford’s strategy is forming strategic partnerships to access advanced technologies and secure critical resources. By collaborating with industry leaders, Ford can tap into expertise and scale faster than it would by developing everything in-house.

Some of the key partnerships include:

These partnerships provide Ford with the technological edge and resources needed to compete in the increasingly competitive EV market, where supply chain security and sustainability are becoming key differentiators.

Ford’s been working on tightening up its operations and cutting down those pesky rising costs by giving its value chain a serious makeover. The goal? Find the trouble spots and shave off some dollars wherever possible. And spoiler alert: tech and automation are playing the starring roles.

Automation: Robots to the Rescue

The company is bringing in the big guns—or rather, the big bots. They’ve got robots and automation humming away in their manufacturing and logistics processes, tackling the boring, repetitive stuff while saving on labor costs and speeding things up. Think fewer mistakes and faster production lines. It’s like having a team of tireless, super-accurate employees who never call in sick.

For example, Ford teamed up with Geek+ and Fetch Robotics to take their warehouse operations to the next level. These bots are handling inventory like pros, getting things in order quicker and with way fewer errors, which means less money wasted on overhead and delays. And hey, that’s more cash in the company’s pocket.

Value Chain Analysis for Targeted Improvements

A critical component of Ford’s strategy is conducting a comprehensive value chain analysis. This involves breaking down every step of the company’s operations—from sourcing raw materials to manufacturing, distribution, and customer service—looking for inefficiencies and areas for cost reduction.

By spotting inefficiencies, they can swoop in with targeted fixes that cut costs and make things run smoother.

Take their supplier network, for example. Ford’s no longer putting all their eggs in one basket. They’re reducing dependency on a few key suppliers, so they’re not left high and dry if there’s a shortage or prices spike. Diversifying suppliers and striking better deals is helping them keep costs down.

The factories are also getting a makeover with lean manufacturing principles and a heavy dose of data-driven decision-making. It’s all about eliminating waste, fine-tuning processes, and being able to pivot quickly when consumer demand shifts.

Its upcoming BlueOval City plant in Tennessee is a prime example—a cutting-edge facility for EV and battery production, packed with renewable energy and smart tech to boost productivity while keeping the planet happy.

Email subscription is available ONLY TODAY (oh, okay, and tomorrow).

Surely, we respect your inbox! Unsubscription works every day.

We’d love to tailor your experience — which of these best describes you?