I know you might be more occupied with ideas, products, and marketing, but studies show that 29% of startups fail because they run out of cash. It’s not all about the idea.

See, I don’t want you to run out of cash. So prepare to put “Finance” into your Instagram bio, because you’re about to learn all of the finance essentials, in the simplest way possible.

When making a decision, you have to know “Why are we making this move?”, and some finance skills will help you with that.

That question is really important because it allows you to… well… not just randomly spend money, but actually use the financial ratios that will get you to your destination.

Let’s start with the most technical stuff first, just to get that out the way.

The most important thing to understand when looking at your company’s finances is income statement ratios. It simply shows your company’s ability to generate income compared to your revenue, physical and nonphysical assets, equity, and operating costs.

Yes, you can look at your sales and expenses, but come on… You can’t just judge a company based on those.

It’s a little more complex than that, sadly.

The income statement ratios help you with three things:

So, here are the different income statement ratios:

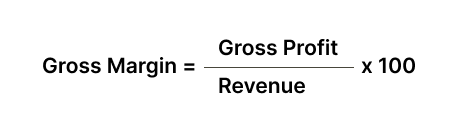

Fancy name, simple concept. This ratio is used to see how much money your company is left with after paying for all the goods (aka after COGS – cost of goods sold).

To get the gross profit, all you do is subtract the COGS from the revenue.

Let’s say your business made $120k in revenue last year. First off, congrats. Also, let’s say it costs you $20k to buy all the materials. That would mean your gross profit is $100k.

Mindblowing, I know.

Then, you just divide $100k by $120k… and you get your gross margin ratio of 0.83 (or 83%).

This means that for every dollar your company makes in revenue, $0.83 is left to cover all operational expenses and profit of the company while $0.17 is spent on the cost of goods sold. Not too shabby!

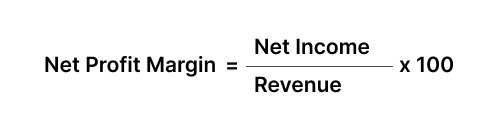

With this financial ratio, you measure your company’s profitability by showing how much your biz makes in profit for a dollar of sale.

Here’s the easy-peasy formula:

To get the net income, you look at the revenue and subtract absolutely every cost, ever. I mean stuff like sales discounts, allowances, and returns.

Example time!

You made $120k in revenue last year, and I’ve already complimented you. The materials cost $60k and every other expense and tax brings you down another $40k.

Net income is what’s left after deducting all expenses, including operating costs, interest, taxes, and any other deductions from total revenue. So, you’re left with $20k after all.

You divide $20k by $120k, and you get your 16.67% net profit margin. Sweet.

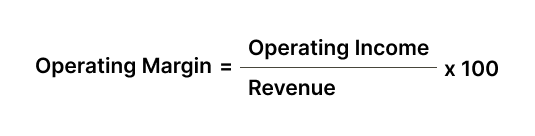

The Operating Margin Ratio sits between the Gross Margin and Net Profit Margin. Here, you don’t take into account all the taxes and interest but do factor in the COGS and operating expenses like wages.

Let’s upgrade you and say that your business reports $450,000 in revenue and has COGS and operating expenses totaling $225,000.

Then, your operating income would be $450k – $225k = $225k.

To get the operating margin ratio, we do $225k ÷ $450k, which is 0.5, or 50%

From the above, it means that for every dollar of sales made by the company, it retains 50 cents from its core business operations to cover taxes, interest, and generate net profit.

Easy as pie.

To put it all into perspective:

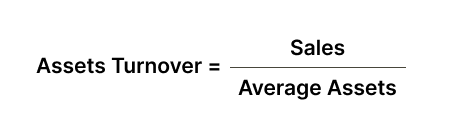

This financial ratio measures how well your company utilizes its assets to generate sales. Basically, how much $$$ you make from what you own. Examples of assets are your inventory, cash, patents, property…

The assets turnover ratio is most applicable to brick-and-mortar businesses. This is because such businesses often have a lot of physical assets (e.g. inventory, equipment, property) and the ratio helps assess how efficiently they generate sales from those assets.

So if you’re an IT startup or digital business, this one may not be too useful for you. I still wanted to put it here though, in case it helps.

Easy enough, and the formula is even easier.

To get the “average assets value”, just take the average of your beginning and ending assets (how much your assets were worth + how much they’re worth now divided by two)

Let me give you an example.

If a company records $600,000 in sales, its beginning assets are valued at $450,000 and its ending assets are valued at $1,000,000 in its income statement. An investor seeking to invest in this company can calculate the company’s assets turnover ratio to determine if they are efficiently using their assets to make sales.

They would whip out their calculators and do:

Average assets = (Beginning assets + ending assets) ÷ 2 = ($45,000 + $1,000,000) ÷ 2 = $1,045,000 ÷ 2 = $522,500

Assets turnover = $600,000 ÷ $522,500

Assets turnover = 1.15

And then they’d say: “Oh look, 1.15, that’s great. Let me invest in that!”

This is basically the same thing as the Assets Turnover Ratio. The only difference is that we don’t look at revenue here but at profits.

To refresh your mind, the ATR asks “How much revenue are we generating per dollar of assets?”

On the other hand, Return On Assets just asks “How much profit are we generating per dollar of assets?”

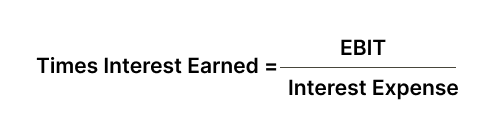

The time interest earned (TIE) ratio is an income statement ratio that measures how well your company can cover its interest payments with its operating income.

If you need to get a loan for your company, this ratio becomes very important. Loans and investments are like gravel – you can use them to fill holes or build up embankments.

Before showing you the TIE formula, let me just tell you a little more about borrowing money.

It’s is a key financial skill for entrepreneurs. If you get a working capital loan, you can avoid equity financing, which can dilute ownership. The working capital loans can be used to purchase inventory, fund marketing campaigns, or cover operational costs.

I know it sounds ideal, but be careful when evaluating the terms and conditions of the loan, including interest rates, repayment terms, and any collateral requirements. This way, the loan supports your growth WITHOUT creating unsustainable debt. Very important thing to avoid.

Let’s get back to the TIE now.

TIE is the ratio to show your bank that they’d be stupid not to loan you some cash. To calculate it, you use this formula:

Example in 3…2…1…

Let’s say Amazon’s net income after tax is $20 million and its interest expense and income tax are $5 million and $8 million.

So its Income Before Interest and Taxes is $20 million + $5 million + $8 million, which equals $33 million.

Now all we do is divide that little $33 million by $5 million and we get a Times Interest Earned of 6.6.

6.6 is quite a high number.

This is a strong indicator of financial health. If you were on the fence about lending money to Amazon, the math gives you a clear green light. (And yes, even without Bezos at the helm, they’re a safe bet.)

🚨LET’S TAKE A BREAK FROM FINANCE FOR A SEC, SHALL WE? 🚨

In this commercial break, I want to give you my free Startup Launch Roadmap eBook.

If you’re an entrepreneur who’s starting a new business and you’d like some more clarity regarding growth, product development, and launch strategy – you’ll devour the eBook

It’s a step-by-step guide (still easy to read though) designed to show you HOW to design your product, how to launch it, and how to scale it.

Get it here, and then let’s come back to the world of finance (if the steps after this page don’t hook you in too much 😉):

Okay… Now we’re done with the formulas and difficult words. Your brain can relax. However, I still have some “philosophies” I want to talk to you about.

For number one, enter Paralysis by Analysis, a phenomenon that infests millions of spreadsheets worldwide.

I’m sure you know what the phenomenon means, so I won’t waste any of your precious time explaining it.

Instead of trying to implement and analyze every financial metric, we recommend you focus on one to four key points that align with your current business needs and stage. I mean, if you’re not looking for investments at the moment, don’t focus on stuff like Times Interest Earned Ratios.

Remember, action often trumps endless analysis, especially in the early stages of a business.

The second skill I want to tell you about is budgeting. Yes, it’s a fundamental financial skill, but it needs to be approached with a modern twist.

Budgeting apps and tools can help you track your expenses more accurately and make informed and nerdy financial decisions. You can use apps like QuickBooks or Xero to automate expense tracking. We recommend you be modern and save yourself some time and human error. It’s the 21st century, after all.

And while we’re at it… please separate your business and personal finances. Running a business from a personal bank account can lead to lots of problems, especially during tax time.

Remember, rent and groceries on one side, business on the other. Your accountant (and future self) will thank you.

As an entrepreneur, you need to have some financial ratios handy to see how well your company is doing and how well it is likely to do in the future. I tried making the needed calculations as simple and easy as possible. Let me recap what we talked about:

Email subscription is available ONLY TODAY (oh, okay, and tomorrow).

Surely, we respect your inbox! Unsubscription works every day.

We’d love to tailor your experience — which of these best describes you?